Beverages will continue to represent more than half of the global aseptic packaging market. Demand for aseptic packaging in beverage applications will benefit from output growth coupled with expanding applications resulting from cost and sustainability benefits of aseptic packaging, especially the ability for dairy and other perishable beverages to be moved via unrefrigerated trucks and stored at ambient temperatures. Gains in the food market will be driven by expanding applications with liquid, low-particulate and pumpable foods, often through the replacement of metal cans and glass jars. Demand for aseptic packaging in pharmaceutical applications will be fueled by preferences for unit-dose and other convenient drug delivery formats combined with the increasing availability and consumption of biotechnology-based drugs, which require the use of aseptic packaging to prevent contamination and assure product sterility.

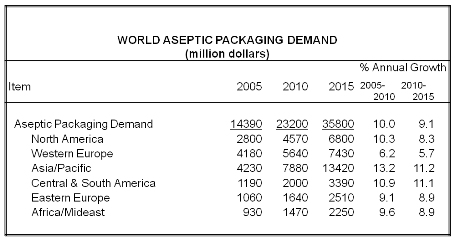

While the US accounted for only 15% of the world aseptic packaging market in 2010, the country represented one-third of the aseptic pharmaceutical packaging market. Gains in the US will reflect the broadening aseptic filling requirements with liquid pharmaceuticals. Overall, the fastest growth in the aseptic packaging market will be seen in Asia, with India and China expected to experience the most rapid increases in the world. Between 2010 and 2015, China alone will account for 28% of global market value gains. Central and South America will also experience above-average advances. Brazil in particular will continue to see double-digit annual growth through the forecast period and beyond, boosted by advances in the large beverage market and expanding food and pharmaceutical applications.