At North America’s big Pack Expo show last month, it was not difficult to see that machinery and material suppliers are working to capitalize on some trends sweeping the packaging industry. For instance, machinery to produce flexible plastic pouches and containers, which dominates other packaging types worldwide, was on wide display. At the co-located Pharma Expo, it was automation and coding technology for the growing healthcare market.

The three-day event, produced by PMMI, the Assn. for Packaging and Processing Technologies, drew 28,699 attendees to view 2,006 exhibitors in 844,510sq ft of the Las Vegas Convention Center. That bested 2013 with 1,788 exhibitors and 27,570 attendees. (In Chicago in 2014, Pack Expo drew 48,000 people and 2,400 exhibitors; the Vegas show held on alternate years is traditionally smaller.)

While there was plenty of evidence of solutions for industrial packaging, consumer packaging trends are actively changing the industry. For instance, sustainability: A number of vendors showed materials made with bioplastics, or touted machine efficiencies that cut down on waste or material costs.

A stronger awareness of environmental issues is one of the top three world trends PMMI has identified in its latest report, “Global Market Trends,” released at the event. The others are greater awareness of health and wellness, and increasing disposable income and purchasing power.

Jorge Izquierdo, VP of market development, shared some of the insights that are driving a shift in how products are packaged. For instance, manufacturers aware of the obesity epidemic are offering 8oz sodas along with 20oz—but not always at a discount.

“They are downsizing but at the same price,” Izquierdo said, adding that more sizes and varieties offer more opportunities for packagers.

And while increasing disposable income in developing countries is boosting prospects for consumer packaged goods makers overseas, those in the U.S. are still somewhat wary following the last decade’s recession. Many turned to store brands then, but “even though their income is better, they are resisting going back to brand” names, he said.

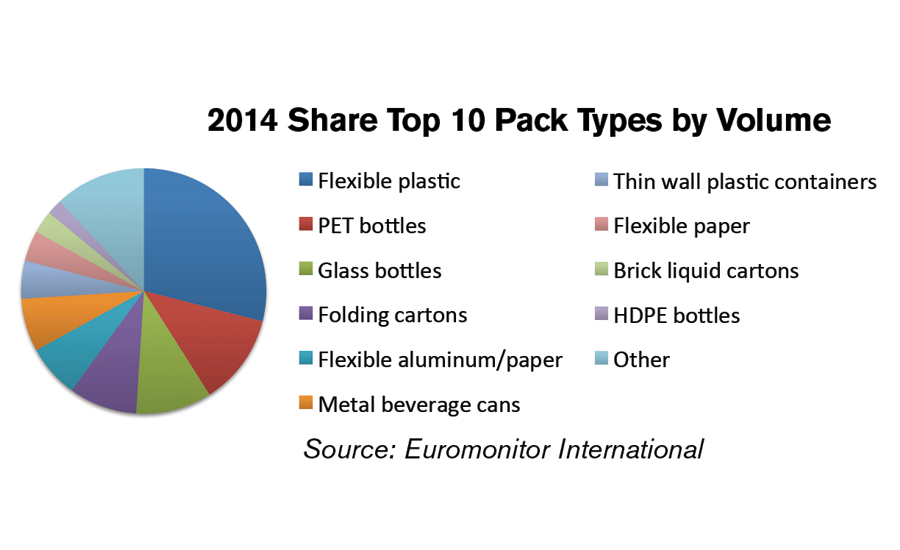

Urbanization and convenience are other trends packagers should know—and which are driving the rise of flexible plastic. By volume, flexible plastic holds the top share worldwide, with 29%, or 1,300bn units, according to data provided by Euromonitor International.

Flexible plastic is expected to grow by 186bn units by 2019. While the top end-use category today (2014 data) is cigarettes, that will be eclipsed by the growth in confectionary, biscuits, snacks, baked goods, and instant noodles, the report says.

PET bottles are currently 12% of the world by volume and growing. In Western Europe, bottled water and beer will surpass cigarettes in total volume by 2019. PET bottles are growing at a rate of 4.7%/year and are expected to add 135bn units over the five years.

Other big growth areas by end-use are yogurt and sour milk products, and juice, each rising at least 5.0%/year. Along with bottled water, they will result in a combined 161bn packaged units by 2019.

Region-wise, Asia Pacific, which has the largest share (46%) of packaging by volume of 2,091bn units, is also expected to exhibit strong growth (4.3%/year) over the 2014-2019 period. Western Europe, the second-largest by region with volume share of 18%, will show growth of only 0.5%.

The most rapid growth, although from a smaller base, will occur in Africa and the Middle East—5.3% a year. North America, at 589bn units, is expected to grow only 0.4%/year.