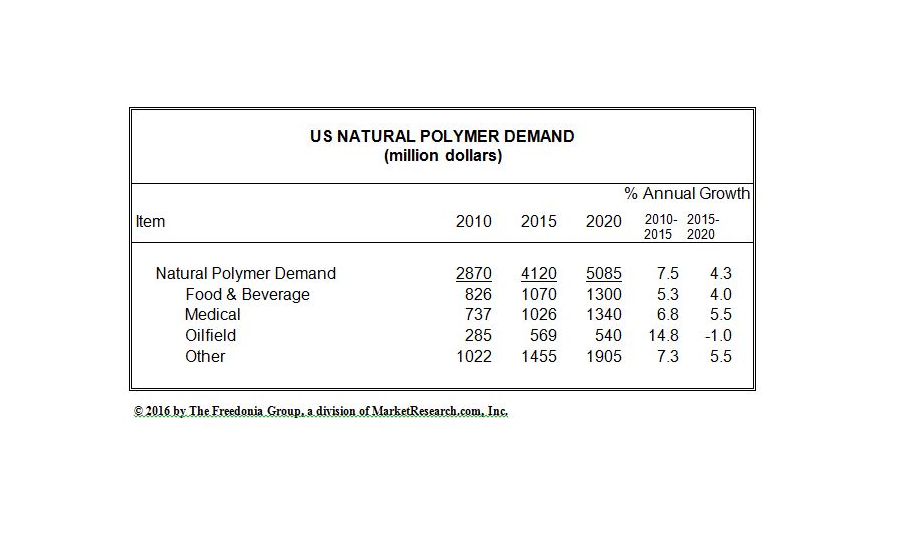

U.S. demand for natural polymers is forecast to expand at a 4.3% annual pace to $5.1 billion in 2020, reaching 1.9 billion pounds. Growth will be driven by demand for natural ingredients in the large food and beverage industry, which will bolster use of cellulose ethers and starch and fermentation polymers. Most product types will benefit from strong demand from the medical market, as natural polymers are used extensively in pharmaceuticals, wound care and orthopedic injections. These and other trends are presented in "Natural Polymers," a new study from The Freedonia Group (freedonia.com).

Cellulose ethers are the largest product type of natural polymer, representing a third of the market. Methyl cellulose will retain its market-leading spot through the forecast period, but demand for hydroxyethyl cellulose (HEC), microcrystalline cellulose (MCC), and carboxymethyl cellulose (CMC) will also be significant. Methyl cellulose’s largest application is construction, where it used in a variety of capacities, including plastering, flooring, grouting, mortaring, tile adhesion, and stucco.

Starch and fermentation products will advance the most rapidly of all natural polymers through 2020, with polylactic acid (PLA) accounting for much of the growth. As capacity increased over the past several years, PLA is one of the few natural polymers that has exhibited declining prices. This has been a boon for the packaging segment, which represents by far the leading outlet for PLA resins. According to analyst Larry Catsonis, “Hyaluronic acid will also support starch and fermentation products’ gains, as it continues to be used to relieve joint pain in orthopedic injections and will also gain market share from collagen as both a dermal and topical tissue filler in cosmetic applications.”

The food and beverage industry will relinquish its spot as the largest outlet for natural polymers to the medical industry in the forecast period. The growth will be driven by strong demand from collagen in wound-care applications as well as cellulose ethers used in pharmaceuticals. Also, oil and gas production followed product price declines into 2015, which led to less demand for oilfield natural polymers, especially guar gum.