The global packaging industry has seen spectacular growth over the past few decades, and this growth has primarily been conditioned by the evolving customer dynamics. Packaging companies have been experimenting with new production and business models to achieve the quality bar and outdistance their competitors, which will remain their strategy over the years to come. Though product quality is and will remain a key touchpoint for customer appeal in packaging, factors that differentiate a specific brand’s offerings are what matters most. This is where digital printing comes into play, bringing new opportunities for brands to explore and reap benefits.

The benefits of digital printing are what the modern packaging sector has been seeking. Digital printing has certainly come a long way in terms adding value. Digitally print is well-suited for small and medium print runs, and this increasingly enables end users to refine experiences of their customers with a tinge of personalization.

Companies active in the flexible packaging market comprise in-house digital printing spaces, whereby they address all the digital printing requirements put forth by their clientele. This is one of the few strategic efforts by these companies to not only offer one-stop convenience to their clientele, but also to generate new profit pools. However, end users are also resorting to contract manufacturing, wherein they reach out to independent firms for seamless integration of digital printing onto their packaging. While users of rigid packaging stand as early adopters of digital printing technology, its penetration in the flexible packaging segment has lagged somewhat as technology develops.

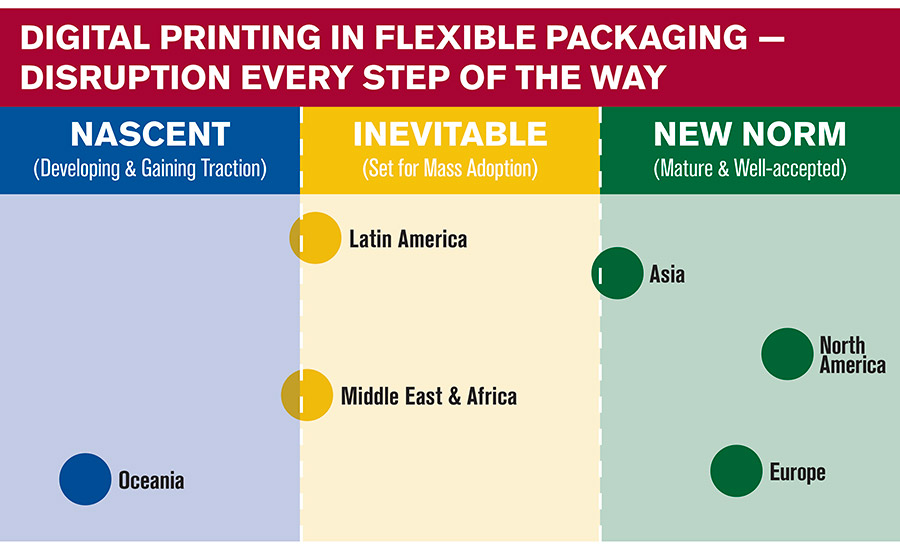

The adoption of digital printing in flexible packaging has not been that prevalent until recently. In addition, challenges posed by the film substrates continued to put a cap on the broader adoption of digital printing in flexible packaging. However, as the demand for flexible packaging continues to take off with improved performance and functional benefits, opportunities for digital printing on flexible packaging will continue to unfold.

North America Leads Digital Revolution

North America retains its position as one of the largest regional flexible packaging markets, accounting for over a quarter of the global consumption. After a slight dip in 2009 brought about by the global economic crisis, this regional market has shown an impressive recovery and continues to be a gold mine of opportunities for digital printing. The U.S. continues to be at the forefront of demand for digitally printed flexible packaging, set in motion by the transition toward sustainable, light-weight, and aesthetically appealing packaging solutions.

Canada also is likely to show exponential growth in the adoption of digitally printed flexible packaging by end of the decade. Though digital printing is clearly emerging as a process of the future in Canada, industry experts say that digital printing technologies still have a long way to go in terms of quality and reliability. Sales of digitally printed packaging in Canada totaled over 13.7 million units in 2018, and is set to see an uptick over the next decade. Such particulars typify the bullish growth prospects for digital printing in Canada, predominantly driven by the growing demand for “connected packaging.”

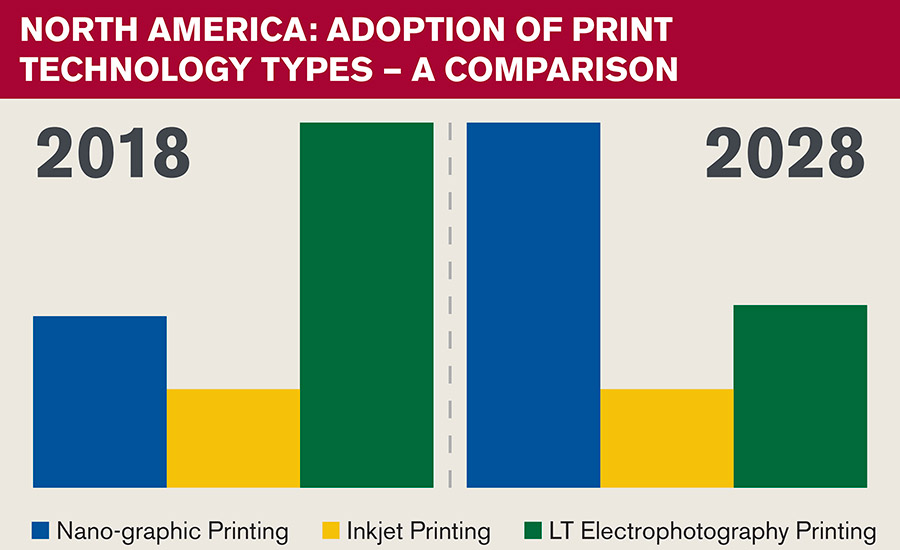

Inkjet printing remains another widely used print technology globally, with electrophotography printing following suit. However, nanographics, another technology, is likely to gain growing acceptance. Nanographic printing, which can bond to all types of films and papers, uses an innovative technique that employs Landa NanoInk, a proprietary water-based ink with nano-pigment particles that measure tens of nanometers in size. While inkjet printing transfers the image directly onto the substrate, nanography first ejects the NanoInk onto a heated blanket, and only then transfers from the blanket to the substrate in the form of an ultra-thin film.

Though demand for digitally printed flexible packaging is ballooning across North America, the monopoly of ‘rigid’ continues to remain strong and profound. Consumption of rigid plastic packaging in North America is marking a sharp increase, thereby adding considerable uncertainties to the current picture of digital printing in flexible packaging.

Personalization Boosts Digital Printing

A set of new trends have been disrupting regional flexible packaging landscapes, and the North American market has been on the forefront of these disruptions. For companies that are adept at embracing those trends and make essential changes in their business models, the opportunity to stand out in a crowded market becomes huge.

One such trend is personalization, in which end user information is incorporated into the flexible packaging solutions. The food and beverage industry has been spearheading the trend of personalization, in which versions of flexible packaging solutions are being used by brand owners to fine-tune consumer engagement via visual cues. Digital printing offers a method for brands to leverage personalized packaging as a key interactive tool.

The North American food and beverage industry is on the cusp of significant shifts, in which consumer satisfaction and engagement hold the key to success. Multiple studies have underlined the fact that consumers spend only a few seconds making their purchase decision, and digitally printed packaging is an opportunity to create consumer interest.

Those benefits are encouraging food and beverage producers to invest in digitally printed packaging, These brands continue to spearhead demand for digital printing in flexible packaging, followed by other applications coming from logistics and transportation, pharmaceuticals, and other end-user segments.

While digital printing already is firmly established in the label and commercial printing, its standing in flexible packaging continues to evolve. Penetration in the flexible packaging market will continue to grow as brands utilize digital printing to engage customers in place of mass-produced packaging.

|

Double-Digit Growth Forecast for Digitally-Printed Packaging In 2019, the total market value of all digital packaging and label printing is $18.9 billion, The digital print market has more than doubled over the past five years in value and print volume, making digital packaging the most dynamic and fastest-growing part of the print market. According to Smithers Pira’s market report “The Future of Digital Print for Packaging to 2024,” the value of the digital packaging sector will reach $31.6 billion, accounting for 6.38 percent of all printed packaging by value in 2024. Increasingly, digital print is being used to print labels, corrugated, cartons, flexibles, rigid plastic and metal packaging. It is taking share from litho, flexo and gravure, while opening up new opportunities. Technology developments have allowed converters to install digital presses that deliver high-quality output, suitable for particular applications, cost-effectively and at high productivity. Digital print gives converters greater agility to meet schedules and version differentiations of brands and retailers.

The study analyzes key factors affecting the market, including:Economic short runs. As with most print products the average run length of label and packaging jobs is decreasing. Digital’s ability to produce short runs economically has changed the label and packaging sectors. Engagement. There are many innovative and creative examples of brands using digital print to create personalized labels and packs, or versions to appeal to sections of the market. Legislation. Increasing legislative pressures on content and identification are driving the information content on many packs and labels. Displaying it in a local language is required in some countries. Security and brand protection. The capability of printing unique information on a package or label also provides new security capabilities. Supply chain benefits. Packaging supply chains have developed over many years, with the great majority of packaging and labels produced by specialist converters. These operations fill the packs and apply labels, adding any coding as required. Complements analog printing. As the number of digital presses installed at converters has grown, users report that digital capability can directly boost the performance of analog printing equipment. Sustainability. Saving resources and acting in an environmentally sustainable manner is no longer merely a trend, but is a prerequisite for future development. The circular economy is becoming mainstream, with supply chains under examination to reduce resource consumption wherever possible. Barriers to digital adoption. There are many reasons why digital labels and packaging are not used. Costs may be too high, there may be problems with design and prepress, colors may not match, inks may not be compatible with substrates, and there may be drying problems. |