A presentation by Richard Freundlich, senior supply chain analyst at Rabobank, reveals that heavy investment in chemical recycling could be the key tool in producing and injecting more recycled content into supply chains, and in the process help retail brands meet higher recycled content material mandates.

Besides chemical recycling, The “Points of Convergence between U.S. and Europe on Sustainability” webinar, sponsored by Taghleef Dynamic Cycle, illustrated the sustainability regulatory framework being put into place by the European Union and how some of these policies may trickle into the U.S., like the extended producer responsibility.

For the European Union (EU), many new regulations have been focused on reducing the use of plastic packaging, improvements in handling waste and increasing use of recycled content in plastics. Freundlich’s presentation shows the lead held by the EU when it comes to recycling rates: 8% to 10% globally, while the EU is averaging 42% plastic recycling rates (2015) compared to 14.6% in the U.S. (2015).

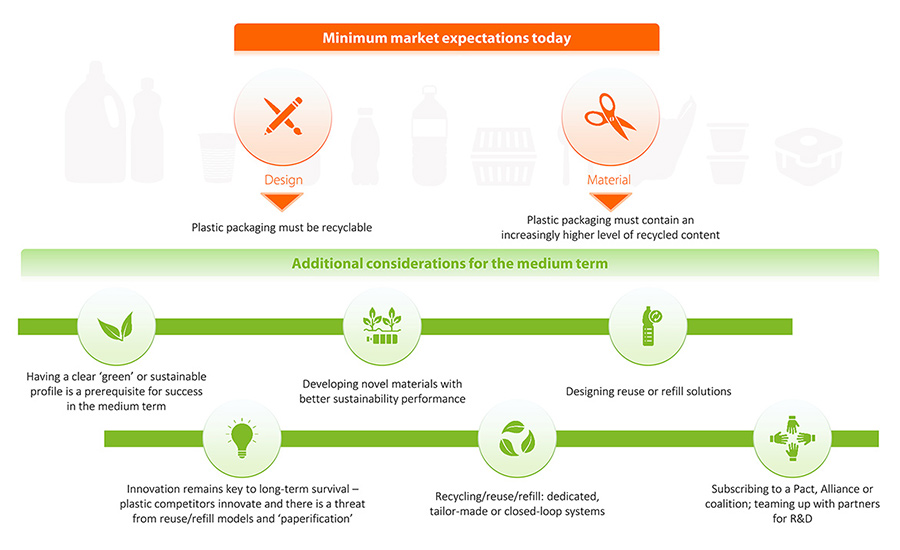

And those recycling rates will continue to rise with Europe’s Green New Deal rules that will impact converters, film suppliers, co-packers and retail brands.

The big takeaways from the rules are packaging will all need to be reusable or recyclable by 2030; increases in higher recycling rates; moving away from single-use plastics; a regulatory framework for biodegradable and biobased plastics and strengthening of extended producer responsibility (EPR), to name a few.

Freundlich also highlighted the “tax liable” plastic packaging proposal being created in the UK that will add £200 per tonne to any plastic packaging components that doesn’t meet 30% recycled content, which go into effect in 2022.

“So liable packaging would cover a finished component, such as cling (shrink) film, and the tax will reside with the importer, but in the UK the liability will sit with the converter,” says Freundlich during the webinar.

The presentation also highlighted more regulations for 2022, including France’s single-use packaging (SUP) rule for the foodservice industry. Plus, France’s national regulatory incentives are already in place for SUP and member states have two years to transition to the new law.

For the U.S., a national regulatory framework or carbon tax isn’t likely, but a national plastics tax is being sponsored in the current national infrastructure bill that would add 20¢ per pound, similar to the resin tax proposed by Sen. Sheldon Whitehouse.

“Many companies and industry groups have signed on to fight this tax in the infrastructure bill and it’s far from being settled (as of press time), but it does have great implications all across all supply chains that use plastic in the U.S.,” says Freundlich.

One form of regulatory action for both the U.S. and Europe is the extended producer responsibility action.

“EPR is all about post-consumer packaging entering the waste stream,” says Freundlich. “Extended responsibility refers to ensuring packaging producers assume some responsibility for the cost, collecting and sorting, recycling, and responsibility for end-of-life.”

Action around EPR is on the state level in the U.S., specifically New York, Maine and Washington’s Assessment law of 2019. With these state laws, producers internalize the costs and proponents say this incentivizes brands to optimize packaging design and material usage.

Breakthrough Technology

As many industry insiders know, the U.S. Plastics Pact has added many multinational corporations to its roster over the last five years and is acting as the de facto industry leader in helping eliminate problematic packaging by 2025. The group has four overarching goals, but one goal that connects Europe and the U.S. is its mission to recycle or compost 50% of plastic packaging by 2025.

Photo courtesy of Courtesy of Rabobank

In order to meet these increased recycling goals, brands and consumer packaged goods (CPG) companies need supply certainties for post-consumer recycled content. Many companies in the Plastics Pact, including Coca-Cola, Walmart and Mars, believe chemical recycling is the way to achieve increased recycled content.

“Right now there are huge investments going on with chemical recycling and pyrolysis in the European Union,” says Freundlich. “Major chemical companies, brand owners and petrochemical companies are collaborating in this area.”

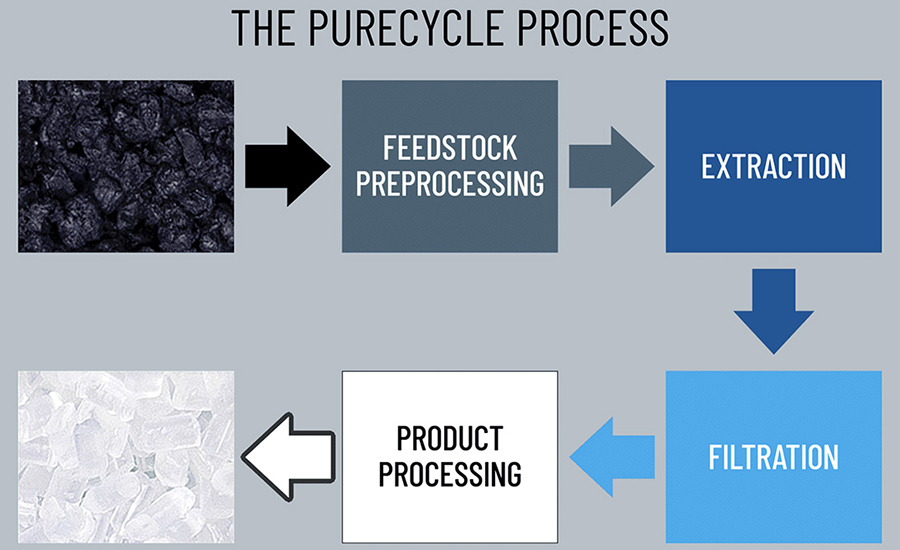

Chemical recycling — or advanced recycling — is the umbrella term for the anaerobic, high-heat process that breaks down commingled plastics. The recycling process produces a feedstock that can be used to form new plastic packaging and move toward a circular economy.

“Member companies in PlasticsEurope are planning to increase their investment in chemical recycling to produce 1.2 metric tons (Mt) in 2025 and 3.4 Mt in 2030 of recycled plastics,” says Markus Steilemann, president of PlasticsEurope and CEO of Covestro at the “Closing the Loop on Chemical Recycling in Europe” conference in May 2021.

Investors in the U.S. are also injecting more capital into chemical recycling technologies, as Braven Environmental — pyrolysis — is building its second plant this year, and Eastman Chemical announced a $250 million advanced recycling plant in Kingsport, Tenn, in 2021 that will convert polyethylene plastic waste via methanolysis and create new monomer structures.

. Photo courtesy of Purecycle

Braven Environmental’s first commercial is located in Zebulon, N.C., and a second pyrolysis plant in Virginia is coming online this year. This new commercial facility will be able to recycle approximately 65,000 Mt of waste plastic per year while producing 50 million liters of its hydrocarbon feedstock. In June, Chevron Phillips announced a long-term buyer’s agreement for Braven’s PyChem feedstock.

With so much investment moving toward chemical recycling, the Independent Commodity Intelligence Services (ICIS) recently released a database in October called the “Recycling Supply Tracker - Chemical.” This global database provides up-to-date information on chemical recycling supply, including installed capacity, output volume, process and feedstock, as well as details about the licensor and investors.

Currently, the ICIS database identifies only around 20% of the global chemical recycling companies that produce polymers as an output of their chemical recycling facilities, while less than 30% of these companies are operating at commercial capacity.

“There is a boom in the number of advanced plastic recycling plants being commissioned worldwide, and by 2025 the U.S. will lead the pack with this technology,” says Freundlich. Overall, Rabobank estimates that the chemical industry footprint might quadruple in size by 2025 to 140 plants with a combined capacity of 3 million to 4 million tons per year.

Freundlich cites the whole supply chain’s is involvement, but there is a particularly strong participation of feedstock suppliers like INEOS Styrolution, Indorama, Dow, SABIC, DuPont Teijin Films and FMCG companies with strong sustainable packaging targets.

For more information on the chemical recycling industry trends or legislation, visit rabobank.com.