In 2013 the market for flexible packaging in the Middle East and Africa is valued by PCI at approaching $4 billion. With consumption per capita currently only around $3 compared to Europe’s $30, there is clearly huge potential for future growth in the region’s flexible packaging market.

In 2013 the market for flexible packaging in the Middle East and Africa is valued by PCI at approaching $4 billion. With consumption per capita currently only around $3 compared to Europe’s $30, there is clearly huge potential for future growth in the region’s flexible packaging market.

As countries in the region grow their economies and look to improve transport and distribution infrastructure and encourage inward investment, more and more multinational brand owners are recognising the potential for local packaged food production to supply the region’s expanding needs.

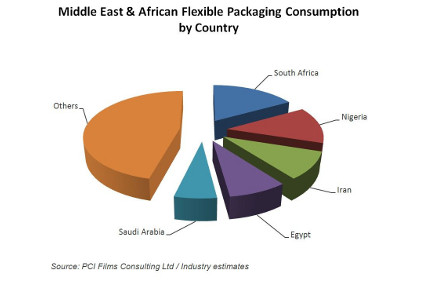

Five countries; South Africa, Nigeria, Iran, Egypt and Saudi Arabia currently account for over half of total consumption of converted flexible packaging in the region. The most dynamic market is Nigeria, where flexible packaging demand has grown by around 12 percent p.a. over the past five years. Other smaller markets such as Tanzania, UAE have also seen above average growth. In contrast to the generally positive picture, flexible packaging sales in Iran and Syria have experienced steep declines due to political, social and economic instability.

So what is driving flexible packaging growth in the region? Some factors identified by the report include:

- A rapidly growing young population and increased urbanisation.

- Increased investment in food production and processing across both regions.

- Significant investments in new flexible packaging converting capacity.

- Increased availability of locally produced and competitively priced base substrates.

- Growth in modern retailing and increased penetration of pre-packed foods.

The region continues to be a net importer of flexible packaging especially into Africa, much being sourced from Europe and increasingly from India and China with the leading European and American owned multinational converters having virtually no local production capability in the region. There is also substantial intra-regional trade, with converters in Saudi Arabia and UAE making use of the films produced as part of downstream petrochemical diversification within those countries. Also Indian entrepreneurs have successfully established thriving converting operations in Nigeria and the UAE.

The region’s flexible packaging market remains very fragmented. Of over 350 converters identified by PCI, the top 20 players account for only around 40 percent of production.

PCI Films’ new report ‘The Middle East & African Flexible Packaging Market to 2018’ analyses key drivers, important end-use sectors and the leading converters with an in-depth analyses of sixteen of the most significant countries in terms of flexible packaging production, trade and consumption, providing: economic overview, flexible packaging overview, drivers and future prospects, converter profiles and end-use markets. The new report, which forecasts national and regional demand through to 2018, provides vital background information for converters and investors considering moves within this dynamic and diverse region.

PCI Films Consulting Ltd

+44(0)1604 749001