If nothing else, 2020 showed us that “the best laid plans of mice and men often go awry.” Is that going to stop people from making plans? No. Is it going to stop Flexible Packaging editors from asking what those plans are and sharing them with everyone? Clearly, no.

We’ve decided to change the format of this section, as you can see. Past years have divided responses from one individual from one company in a sector, typically representing converters, suppliers, manufacturers and/or CPGs. Our own take on the past year showed us how interconnected we actually all are. In a bit of existential thinking, we decided to reflect that here and include responses to a common theme from multiple people in various segments of the industry. We start out with lessons learned from 2020 and then ask how those lessons are affecting expectations for 2021.

We also reserve the right to deny the accuracy of any of these predictions should another unforeseen calamity befall us, like a meteorite strike or Godzilla attack.

Click below section list to jump to each topic of discussion:

2020 Overall/Challenges

2020 has been an unprecedented year for us all. HP Indigo has focused its efforts on managing the wellbeing of our partners, customers and their families with urgency and a deep sense of care. On reflection, despite initial uncertainty, it has been brilliant to see how the industrial businesses have adapted and evolved to bring a sense of hope and positivity to the industry.

For Indigo customers, this year has been one of challenges but also one of very concrete opportunities. The innovation that defines them enabled them to quickly respond to the changes in the market — for example, ensuring robust supply chains, and also meeting the surge in demand for labels and packaging in diverse sectors such as healthcare, food, home improvement and more.

Our flexibles division had a very good year across all of our key metrics. The team managed the challenges and opportunities related to COVID while at the same time keeping focused on our customers, driving process and productivity. Building a robust contingency planning competency was an area that we invested significantly in the past few years. We saw the benefit of this hard work during the sudden changes that the industry experienced in 2020.

We’re still reviewing the year, but an early assessment is that the strength of our network and footprint, the power of our partnerships and our clear commitment to collaboration as a value — both internally and with our customers — have resulted in wins for customers and our business. Our business continuity plans served us well through the onset of the pandemic. Our colleagues take great pride in supporting our customers’ ongoing ability to deliver the products that consumers need most during difficult times. As we look forward, our expectation is that we will continue to review conditions and adapt as we have for the last eight months.

Despite the challenges that COVID-19 has presented in 2020, Sun Chemical made sure its contingency plans were in place and ready to be executed upon as needed. With numerous manufacturing sites around the world, Sun Chemical maintained flexibility with manufactured volumes in order to meet customer demands and our procurement team has done an outstanding job to ensure we did not experience inventory issues. The largest operational challenges have been to keep pace with evolving regional regulations and developing effective screening and disinfection protocols to maintain the safety of our employees.

We are living days that will shape the way to conduct business in the future. There will be a “before 2020” and an “after 2020” when referring to the way an industry works. In this global disaster we had the chance to operate within an industry that is essential to everybody’s lives and wellbeing. Almost all of the players within our industry have been rated an “essential businesses.” So were we. Speed in reaction time and the adaptation to the situation was essential. Industry 4.0, IOT and a digital mindset were also part of the solution. To deliver products and services was the challenge, and we have been able to perform by combining all of the above. Those few within the value chain that have been able to shape their business quickly and efficiently have in fact limited the consequences to the very minimum. This applies to all members of the value chain: brand owners, retail traders, industries, converters, suppliers. Nordmeccanica is closing 2020 sharp on the year forecast that was issued over one year ago and well before the pandemic. In the machinery business, the ability to stand was connected with the ability to deliver products and to set them up and running. We were installing major machines at customer locations, with no physical presence but by remote supervision, as early as April 2020. By mid-July, the time lost in production during the total lockdown was completely recovered, and customer confidence in assigning new orders was rewarded by our proven ability to perform. Over 220 machines have been installed globally in 2020. We have orders that brings us well into the third quarter of next year. This last fact is essential for OEM’s financial health, especially during this financial crisis. We have to thank our customers, our perseverance in properly serving them, our total digital machine set up and the chance to work within an industry that serves primary needs. We were ready to handle the situation with a “disaster” sort of plan at the time when nobody knew what could have been the evolution of the situation. In early March, as soon as we were mandatorily forced to stay home, we were brainstorming and evaluating moves based on alternative scenarios. We went well into the alphabet and way beyond “plan B.” Eventually it was easier than we feared as the reality was shaping up. Using to the full extent the advanced technology we have been implementing in our products allowed us to set up the action protocols that resulted in our ability to successfully comply with all our duties.

Trends Impacting the Industry/Customer Trends and Opportunities

The trending rise of small brands and local manufacturing continues. Digital print with Indigo makes it possible for converters to say yes to delivering virtually any job, simple or complex, single or multiple SKU, static or with variable data the same or next day. 2020 has proven the need for a digital-first mentality, as the industry moves quickly to cope with new demand, investing in the right set of technologies now will pay dividends in the future.

The word “digital” often means “virtual” in the age of COVID — the way we often learn, work and engage with friends and family. In the print industry, “digital” also stands for benefits that answer the needs for shorter runs, faster turnaround times, more flexibility and increased personalization. These trends have all accelerated over this unprecedented year.

We have been able to prove that remote customer care, remote after-sales services, remote installations, remote start-up and remote training can be safely and successfully implemented during days of need. Will that shape the way an OEM will handle business in the future as we slowly go back to normality? Certainly, yes. Handling hundreds of meetings online has been a major lesson-learned by the industry. It was occasionally used “before 2020,” it will be the norm in the future. The steps of our business that are related to the actual product will benefit cost reductions as allowed by the digital technology and, therefore, by the ability to remotely handle some step of a project. Efficiency and a shorter time to business will also benefit by this approach. Function by function, it will be a mix of the old and the new way “after 2020.”

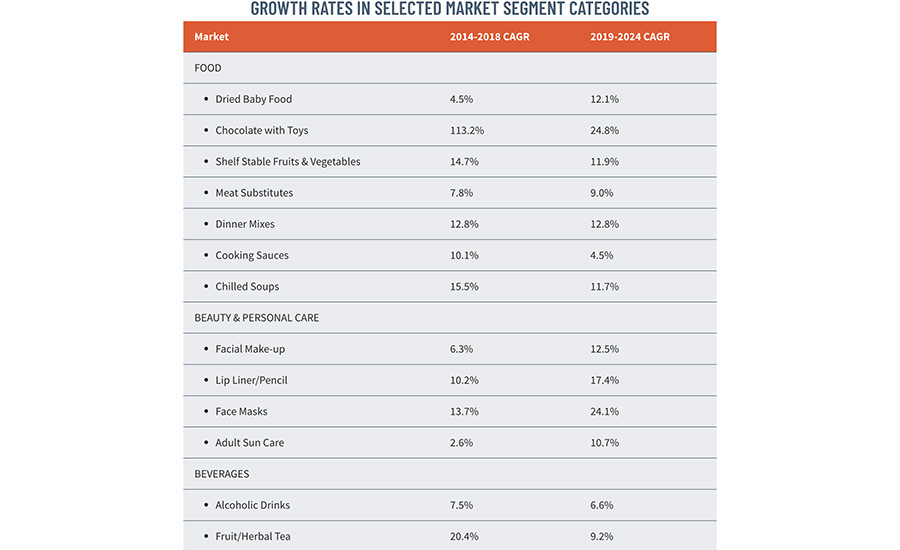

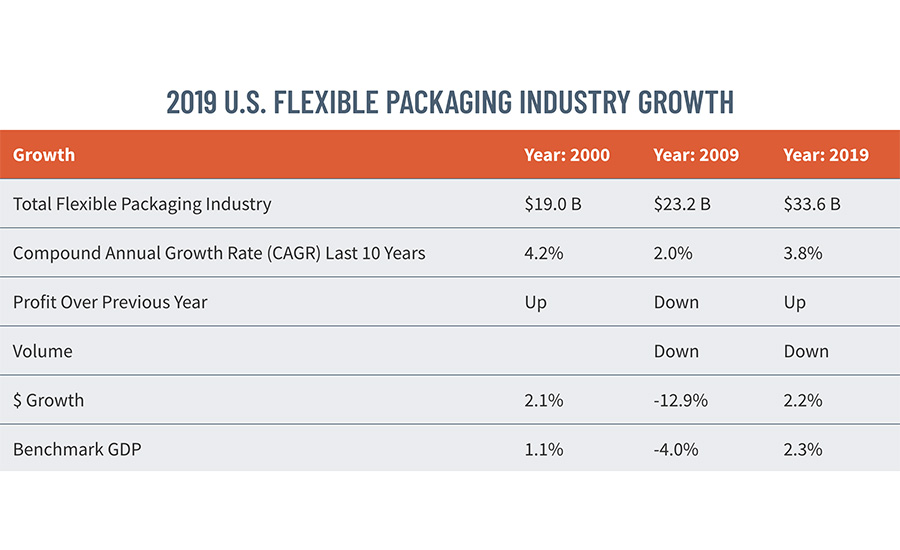

COVID-19 changed purchasing habits, which greatly increased demand for some market segments, like packaged food, health and hygiene, e-commerce and PPE. Many flexible packaging manufacturers switched assets to produce PPE during this time. And while the industry saw decreased demand in institutional food purchases as many schools and restaurants closed, the increase in the other market segments as well as take-out food packaging appears to have insulated the industry greatly from the economic impacts of the pandemic so that growth is still projected to be on par with GDP.

The pandemic caused significant disruption in global supply chains as well as price volatility in some key raw material categories. Shifting demand away from industrial applications to healthcare use exerted pressure on solvents. As far as a supply chain impact in general, all regions around the world were and are still impacted. Areas in Asia have been a primary focus for us as many materials are sourced from regions such as China, India, etc. Although we monitor these regions regularly, COVID-19 has triggered us to monitor purchase orders and supply positions daily, especially as the situation was changing rapidly. Additionally, the global supply of pigments, pigment intermediates and various specialty chemicals were threatened by compromised distribution channels and limited available labor. Since packaging was an essential business, the flexible packaging market itself continued to see strong growth in 2020. There are three key trends driving the growth in flexible packaging: sustainability initiatives, convenience and smart packaging. From a sustainability standpoint, these market trends include key changes in the package itself, such as better barrier protection, light weighting, recyclability and compostability. Also, despite behavior changes in shopping, convenience packaging has still been on the rise since younger single households don’t cook huge meals. Sun Chemical continues to provide the widest breadth of products available on the market for package printers that address a wide range of the industry’s key challenges, including migration, the push toward smaller package size, recyclability, shelf life and other efforts to reduce the impact of packaging on the environment. We are also working closely with brand owners and major packaging groups to provide them with solutions for specialized packaging of the future.

The Importance of Industry Collaboration

We will continue to evaluate and improve upon the flexibility and responsiveness of the entire supply chain. Operationally, we will continue to keep the safety measures in place that are there to protect our employees’ health and safety amidst the COVID pandemic.

Responsive and accurate forecasting has always been a priority for our business. During the pandemic, we increased the frequency of customer check-ins, which delivered accelerated updates to forecasts — daily in some cases — better monitoring of marketplace activity and an enhanced ability to quickly make needed adjustments in our operations so that our customers could reliably get their brands to the shelf. These process improvements will continue to be a focus for us as we move forward. We believe our response during the pandemic — our ability to collaborate with and continue serving our customers — differentiates Amcor as a trusted partner and will strengthen customer confidence in our ongoing ability to meet their packaging needs.

2020 has been an unprecedented year for us all. HP Indigo has focused its efforts on managing the wellbeing of our partners, customers and their families with urgency and a deep sense of care. On reflection, despite initial uncertainty, it has been brilliant to see how the industrial businesses have adapted and evolved to bring a sense of hope and positivity to the industry.

On the subject of communication between us, an OEM and our customers, there will be important changes that will influence the future. Trade show cancellations have reduced our ability to communicate. Our solution was to implement — and globally be the first ones in our industry — an innovative form of communication based on live events broadcast globally. The format named “Nordmeccanica Events” has already generated three episodes, now available in download streaming, where we demonstrate live: machine operations, technical innovations and news. It was a small revolution, an actual show that allowed customers to attend conveniently while staying home or at their office. At zero cost to our guest, it gives us the ability to show them our machines and technological innovations to the full extent. We have an audience in the thousands between the guests who attend live and those who attend in download streaming — a way larger number than one we can target during trade shows that remain very expansive to visitors.

Our extensive raw material supply portfolio and global manufacturing footprint supports essential businesses, and these areas of focus required us to work very closely with our customers and suppliers. Communication of our requirements to suppliers has been elevated to an even greater level of frequency, almost a daily basis, to ensure our demand plan is understood for all product lines globally. We have also been working closely with our customers to understand their expected volumes along with the changing dynamics of their customer base. Constant communication has been critical as we work through these challenging times. Additionally, we took the necessary precautions at all our locations to help prevent the spread of the virus and to ensure the continued health and safety of Sun Chemical employees. Sun Chemical’s Environmental Health and Safety department has been committed to working tirelessly to assist the labs, factories and remote work force to achieve compliance and ensure the safety of our staff. Where it made sense to do so, we closed some of our offices and provided the tools and safety guidance to those working remotely. These types of efforts will continue regardless of the situation. COVID-19 also affected all players in the global supply chain, including over-the-road carriers, ocean freight carriers, and warehouse and distribution center providers, among others. Frequent communication and data sharing remain critical and will remain critical into 2021, in order for our fully integrated supply chain to be effective to meet customer demand, volumes and requirements.

The Impact of E-Commerce

Mega trends favorable to digital printing are accelerating including the need to respond with high agility to market changes and the growth of ecommerce. The industry has also discovered new opportunities for digital printing, with the need for automation, profitability and differentiation. I approach 2021 with a positive mindset and confidence that the industry will continue to grow and serve brands and communities around the world.

On the commercial print side, eCommerce and web-to-print are flourishing, and here too there is an expectation from end customers for faster turnaround times and innovative applications. These all point to an increase in demand for digital print, and Indigo in particular.

The COVID-19 crisis made e-commerce a bigger focus channel for our customers. For many CPGs, online grocery shoppers are a primary target because online grocery channels in the U.S. are expected to reach $60 billion (+20%) by 2023. There’s never been a better time to focus on the next generation of fully optimized e-commerce packaging, but one-size-fits-all doesn’t clear all the hurdles in the online economy. Amcor’s product portfolio is uniquely positioned to deliver success because of the breadth and depth of our offering, which includes testing. Specific e-commerce-ready formats often are required to protect products and deliver on the brand’s promise from the point of shipment, so testing is a must. As an official participant in the Amazon Packaging Support and Supplier Network (APASS), Amcor offers resources to inform packaging development, including ISTA and ASTM testing facilities.

Sustainability goals remain a priority in e-commerce channels. Amcor’s ASSET lifecycle assessment tool means we can quantifiably measure the impact of the full package lifecycle, from extraction of raw materials to end-of-life. While some launches were paused, increased focus was placed on helping CPGs optimize their SKUs to meet the increased consumer demand, improve operational efficiencies on the line, and drive e-commerce packaging as it became the channel everyone was talking about. We’ll continue to capitalize on those things in 2021.

The requirement of increased product protection and counterfeit protection triggered by e-commerce calls for additional capacity and the investment on technologies that we provide within our group. We have seen numbers growing in that direction region by region, and we think the trend will stay as the e-commerce share of business, region by region, is growing.

The Consumer Shift to Sustainability

We expect the focus on sustainability to continue for our customers and expect their efforts to intensify as we move closer to 2025 goals. We also expect to see a continued focus by our customers on minimizing the numbers of SKUs, focusing their resources on higher volume SKUs.

Amcor’s innovation, and research and development capabilities have positioned our business to deliver on more sustainable packaging for the industry. As consumers’ purchasing behaviors change, as they choose more sustainable packaging, these shifts represent a fantastic opportunity for Amcor to help our customers grow their business and their brand loyalty. What our customers are beginning to see is that more sustainable packaging doesn’t have to mean compromising on other packaging benefits, they can have it all. Amcor is also leading the way when it comes to helping customers and consumers alike understand that sustainability means the entire lifecycle of a product — from production of resin to end-of-life options for packaging. We’ve established dynamic global partnerships with organizations like the Ellen MacArthur Foundation, Materials Recovery for the Future (MRFF), Association of Plastics Recyclers (APR), How2Recycle.com and the Ocean Conservancy. Together, we’re turning up the volume on conversations about critical packaging benefits — like optimized packaging weight and reduced quantities of plastic, use of post-consumer recycled content (PCR), carbon footprint reduction and recycling stream infrastructure needs. Innovation and sustainability remain key to our customers’ growth, even during the pandemic.

Consumer packaged goods companies are looking for support in their sustainability efforts and Sun Chemical has helped by providing solutions that meet their goals of resource reduction, a smaller number of packaging layers, along with decreased package size. We have seen challenges regarding the “sustainability” cry across the globe, creating products that fulfill the needs at a competitive cost. We continue to work with printers to offer solutions that address customer needs, which is why we’re moving toward sustainable product offerings that utilize raw materials that promote bio-renewability, recyclability and compostability. Additionally, biodegradable and more recyclable flexible packaging materials are currently favored by both major retailers and brand owners. For example, SunVisto AquaGreen is a water-based ink with a higher biorenewable content, offering a natural, cleaner, greener option for food packaging, and SunSpecto SolvaGreen is a compostable, solvent-based ink for surface printing on biodegradable films. Sun Chemical anticipates further growth opportunities from these key areas related to sustainability, in addition to further growth thanks to the recent launch of our newest range of liquid inks with very high renewable content. Through the use of SunBar barrier coating, SunSys protective coatings and SunFuse sealants and primers, we can allow for flexible package designs with improved recyclability. Anytime a flexible package uses more than one type of substrates (for example, polyethylene film laminated to polypropylene film), that structure becomes more difficult to recycle. By using coatings to replace these layers, functional mono-material packages can make recycling a reality for flexible packaging. We can also add functionality to bio-based films and even paper to enable the design of biodegradable packages.

We, as a machinery manufacturer, are involved deeply in the evolution of new technologies for our industry. Collaboration through the value chain gives substantial results when a product evolves or a new technology is implemented — that needs the contribution of all players. In 2016 we, in partnership with Dow, introduced a technology that grants very fast curing to solvent-less adhesives, it consequently created a substantially shorter time to market, and energy and scrap savings. And, as a team, we made a statement. When in 2018 we, in partnership with Henkel, introduced a new performance coat that boosts barrier enhancement in flexpack compounds, we, as a team, made a statement. It is about real innovation and real innovation implemented quickly because of constructive collaborations. They are innovations offering “real” and “original” results — possibly not perceivable by consumers — but it’s innovation that brings real value to sustainability. Consumer perception about packaging is heavily influenced by brand owners, retailers and media, and it’s not always informed by actual facts. We try to address real issues. Our responsibility is to the improvement of technologies that we have introduced to the industry and producing remarkable results in terms of emission elimination, scrap reduction and energy-efficiency optimization.

Trends/Challenges/Opportunities In 2021

Across the last eight months, consumers turned to products they were confident were safe and also were affordable. Part of that confidence has to do with Amcor’s packaging, underscoring our long-held position that packaging has a role to play in making brands successful in the marketplace. The industry may be challenged by the possibility of escalating material costs. This is something that we continue to monitor. For our part, we believe our broad global footprint and industry-leading purchasing power will help reduce the risk of cost increases to our customers, which is always a focus for them.

The healthy growth of HP Indigo labels and packaging printing experienced in 2020 is expected to continue in 2021. Some verticals such as food, beer and cleaning products experienced especially high demand. While the pandemic will be over sooner or later, it has accelerated several mega trends providing tailwind to digital print, especially the need for agile supply chain, fast time to market and a versatile digital press.

This year we also saw a doubling of the use of applications in PrintOS for managing and optimizing production, ensuring the right technical skills and training for their teams, and completing complex processes such as installations and remote services. No less importantly, we saw the importance of collaboration and the support of the community, with so many of our customers and Dscoop stepping up to help their communities and each other. Looking ahead to 2021, we believe that these trends will remain, and likely continue to accelerate. In fact, PSPs will see capabilities like automation, smart manufacturing and diversity of applications move from “contributing factors” to their competitive advantages to capabilities that are business critical.

Keeping our employees and healthy and safe will be our key priority in 2021. In addition, the ability to accelerate efforts around cost-effective sustainable packaging will be a key opportunity for the industry in 2021. I also feel like the industry will need to manage through much more inflation in 2021.

Because of the current global situation, it is quite difficult to envision what 2021 will bring. I am sure that a growth in our industry will be a result. There will be a significant re-distribution of the global production resources for flexible packaging, especially the high-end one, as self-sufficiency will be an important target for most countries and regions. New product opportunities will be offered to converters as a result of the need for improved hygiene and consumer protection. We just have to hope that governments on a global scale will act in the interest of people and businesses to carry over to the post-COVID era.

COVID-19 also generally provided a pause in the policy measures that will impact the industry, such as single-use plastic bans and recycling and recycled-content mandates. These drivers will all be back in 2021, however, with the industry projected to see packaging legislation in at least five states. This legislation will focus on extended producer responsibility schemes, where packaging fees will go toward increasing the collection and recycling of all packaging types. As many industry and government coalitions are working on the issue, FPA is particularly interested in those schemes that provide an “on ramp” for flexible packaging, which has very limited collection and recycling opportunities today and a lack of a variety of end-markets. The right schemes could enable needed investment in current and advanced recycling infrastructure for all flexible packaging in the future.

As 2020 comes to a close, we will continue to monitor the changing economic and health landscape to assist us in making the right decisions for our customers and our employees. When a vaccine is released, we will plan to re-evaluate our current processes, while keeping safety for all our top priority. By recognizing the importance of sustainability as a global issue, not only is Sun Chemical supporting the packaging industry, but we’re also aligning our goals with those of the United Nations in its Transforming our World: the 2030 Agenda for Sustainable Development. We have therefore identified a number of the 17 UN goals on which the actions we’re taking to help to develop a more sustainable packaging industry will, we believe, have a positive impact.