|

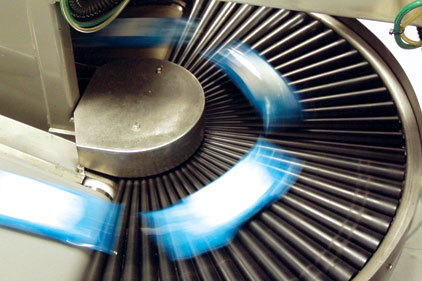

| For obvious reasons, a company wants to run at maximum efficiencies. |

Everyone knows that efficiency and automation have become critical to survival in US manufacturing. Perhaps Russ Salzer of Product Handling Concepts (PHC) says it best: “Companies no longer have fully staffed engineering departments with the depth that can take projects from design to implementation.” This is especially true in the lean converting enterprises that are often the stars of the flexible packaging scene.

In the past, the manufacturing staff engineers could oversee the whole process selecting various suppliers for portions of the project. It was not uncommon for company engineers to work with various vendors on production line sections and build an outcome where only they knew the whole story. This approach has not been working as well with minimal internal staff that has to coordinate suppliers.

“Now there's a balance between wanting to maintain control and having vendors that can act as overall project managers,” says Salzer. Connectivity between all the vendors and segments has to be synchronized. With the increasing view of raw materials-to-finished package as a seamless process, the value of being able to manage the total picture emerges.

One segment in converting and packaging feeds another, so that each point downstream is capable of handling maximum capacity that’s coming at it from upstream.

“Our efficiency and ability to run small jobs comes from having our lines designed for fast changeover,” says Brad McKay of Top Brass Inc., makers of wet wipes in flexible packs. “Four to six hours or less is typical for us to move from one product to another.”

Obvious examples are seen in converting processes every day. “We can spit out slit rolls faster than we can pack,” says Gary Forehand of American Custom Converting. “You want to run at maximum efficiency; so we start to look at the next steps in investment.” A wish list for this flexible, small converter includes a combination of new and used equipment. “Our track record of re-inventing production lines is a factor,” he says. “On the data side, we make the machines smarter so people can make better decisions.”

In a similar way, Precision Paper Converters is investing in new equipment and by expanding implementation of LEAN concepts and tools. PPC's Jeff Anderson says, “We’ve also greatly improved our training program so all our team members have the tools and ability to spot, suggest and implement improvement opportunities.”

In different market segments, there are issues affecting that world most strongly. For example, in towel-and-tissue with older infrastructure, market competitive forces often drive searches for market share and profitability. In newer substrate markets such as nonwovens, research and development more often drives production approaches.

What’s on the horizon is increased overall efficiency through systems improvements, latest equipment upgrades and robotics, with an eye on disruptive technology breakthrough. Schwan talks about the need for flexibility in solutions to handle marketing changes in package design, quantities, sizes and new SKUs.

Innovation comes from many sources today, and increasingly, from companies where the entire focus is on efficiency and related areas of expertise. The view has to include big-picture, whole-line solutions. Salzer of PHC typifies the latest supplier offerings: “We don't just assume it will all come together,” says Salzer of PHC, “it's our absolute mission.”

Many of the companies in this efficient converting arena will be on hand for the Seventh Annual Converters Expo in the heart of the converting corridor at Green Bay's Lambeau Field atrium. www.ConvertersExpo.com