The global flexible packaging market enjoyed another strong year in 2014, with revenue growth rates significantly higher than many countries’ gross domestic product. The sales growth rates for value-added flexible packaging were even higher, with some estimates as high as 7 percent.

One of the fastest-growing segments of flexible packaging is the pouch, a nearly $8 billion business in the U.S. that is growing at a rate of 4.6 percent a year, according to market researcher Freedonia Group. Overall, there are expected to be 92 billion pouches produced by 2018.

Standup pouches are rising even faster, with growth projected to be 6.5 percent a year to $2.4 billion in 2013-2018. Standup pouches represent nearly a quarter of the U.S. market.

Driving demand is interest from packaged goods manufacturers who save money by using plastic instead of more expensive materials like glass or metal – as well as in transportation and energy costs because their lighter weight makes them easier to ship in fewer trips. Marketers also like their shiny surfaces with lots of billboard space and a contemporary look.

Convenience is also a factor, as pouches are easily tossed in a tote bag for outings to the park, office lunches (think tuna fish), or outdoor concerts. Sipping drinks from a pouch via a straw as in juices, or by turning a spigot as with wines, eliminates the need for heavy glass bottles or an opener.

Technology and innovation have advanced hand-in-hand with the rising interest in pouches. New barrier films, seals, closures and other complex material structures and shapes have evolved enabling brand owners to extend their uses to such items as motor oil and liquid detergents. Growing usage beyond food and beverage to sectors such as pharmaceutical is also benefitting pouch makers.

More than two decades ago, the Packaging Strategies group saw the burgeoning interest in flexible packaging and pouches and created a forum for packagers and consumer goods executives to come together and share the latest in knowledge and development.

This June, the 18th Global Pouch Forum will be held, which is the largest event of its kind in North America. The June 10-12 conference is moving to Miami from Fort Lauderdale, but is still expected to draw a sell-out crowd of 500. In addition to 1 ½ days of presentations and panels, attendees will have the opportunity to attend a technical pre-conference symposium produced by TAPPI PLACE, as well as tour nearby Florida pouch converter Karlville Development’s plant. (See the full agenda on the following pages or at www.globalpouchforum.com.)

The main Forum program showcases an exciting lineup of 25 speakers on topics including growth forecasts, recycling, safety, convenience, printing, beverages, food processing, mergers and acquisitions, and consumer insights.

Built in is plenty of networking time and two hosted receptions: A welcome reception on June 10 and a table-top exhibition the evening of June 11. More than 80 exhibitors – a record for this event – will be showing their products and services.

Here is the lineup of some of the exciting sessions ahead:

ConAgra’s Microwave Popcorn Transformed

Keynote speaker Robert Weick is vice president of packaging optimization for ConAgra Foods Inc., one of the largest suppliers of packaged foods in the world. He has a long pedigree in packaging, helping ConAgra and PepsiCo introduce new products from pasta to popcorn. Currently he works across the supply chain to recommend efficiencies throughout the system.

In his decades-long career, Weick has been focused on integrating what he learns from consumers into package manufacturing. For instance, a pop-up bowl he helped create for the Orville Redenbacher microwave popcorn brand “was rooted in consumer behavior. We looked at what turns on the consumer and it turns out they didn’t know how popcorn popped.”

He found that many consumers wanted to know what it looked like and mothers wanted to be rid of passing out multiple dishes. The pop-up bowl – a microwave bag (with a see-through window) that is its own container – was born.

“Moms are now buying three different types of pop-up bowls, one for each kid, and they can throw it away with no mess,” he says. The bowl has helped the category achieve 19 percent growth, Weick adds.

He says manufacturers need to listen closely to buyers. “You have five seconds at five feet before they open the freezer case door. You want to exceed their expectations.”

Market Forecasts

Two of the world’s leading market researchers will be reviewing the global markets for flexible packaging and pouches, and will give their forecasts for growth and perceptions of what is driving demand.

Dominic Cakebread is head of Smithers Pira’s packaging consulting. Based in the U.K., he has written and managed more than 500 international marketing research reports and has consulted with leading packaging clients around the world.

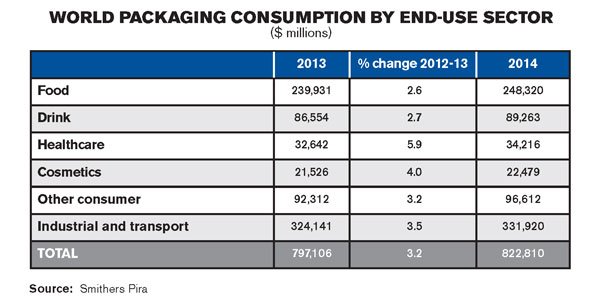

Smithers Pira valued the 2014 world packaging industry at $822.81 billion and expects it to rise an average of 3.4 percent a year to reach $1.155 trillion in 2014.

Growth will be fastest in Asia, which is expected to grow more than 6 percent a year on average through 2018.

Jörg Schoenwald, president of Schoenwald Consulting in Erlangen, Germany, published a new market report on standup pouches last year. He estimates the global annual growth rate over the next three years for this type is more than 7 percent. U.S. sales will reach almost $12 billion in 2018; however, the Asia-Pacific region dominates with more than 50 percent of the global standup pouch market.

“The process of growth of standup pouches is globally unbroken,” Schoenwald notes.

Food Company Presentations

Campbell Soup Co.’s global baking and snacking segment is a more than $2 billion business. Matthew Dingee, a senior packaging engineer in Toronto, will relate how he worked with a supplier to introduce a new adhesive closure for Pepperidge Farms cracker chips throughout North America. “In the flexible world there is more opportunity if you have the courage to bring it to the forefront,” he says.

Tree Top Inc. started using preform pouches five years ago and then moved into form fill seal. Andy Juarez, director of engineering, and Dan Mathison, director of contract manufacturing, will talk about how the company worked closely with machinery and materials suppliers to come up with the best solution for standup spouted pouches for applesauce, which have exceeded sales expectation.

There is much more about food and pouches, including a panel on pouch-filling challenges and capabilities, featuring pouch-making suppliers and equipment manufacturers, and a panel on food processing.

For the first time in two years, the Forum will include a session on printing, which includes manager Roy Oomen from Hewlett Packard’s Indigo digital business, and Tim Cain and Karl Swanson, from Breit Technologies and PCT Engineered Systems, who will talk about decorating techniques on flexible substrates.

They will be followed by an intriguing session on alcoholic drinks in pouches, timed just before the 5 p.m. exhibition and reception. AstraPouch is one of the biggest suppliers of pouches for wine and spirits. It makes easy-to-open, leak-proof and fridge-friendly pouches for wineries all over the country, including newly formed Crystal Beach Cellars of New York, which will also be represented. AstraPouch was started by longtime wine and spirits insider Dave Moynihan, a former executive at Constellation Brands.

Recycling

Recycling is a big issue for the flexible packaging industry. At the Flexible Packaging Association meeting recently, speakers outlined the need for suppliers to educate and promote a fully recyclable waste stream.

What should be done with plastic that can’t be widely recycled and what alternatives are there to throwing it in the landfill? Who should be responsible? Two widely known speakers on sustainability will look at the idea of extended producer responsibility – making brand owners and retailers take back the waste they create from packaging – and what markets exist for single-resin and multi-resin films.

Speaking will be Betsy Dorn, U.S. consulting director at Reclay StewardEdge, and Victor Bell, president of Environmental Packaging International.

Also at the Global Pouch Forum will be two returning speakers, Dennis Calamusa, president of AlliedFlex Technologies Inc., and Sal Pellingra, vice president of innovation at Ampac, who always receive high marks from the audience. They will talk about products that have been hits with shoppers, and about customer convenience versus sustainability.

Giving a consumer perspective will be Scott Young, president of Perception Research Services. John Hart, a managing director at P&M Corporate Finance, will detail the hot merger and acquisition landscape, and Naeem Mady will stress the importance of testing for safety and government compliance.

That’s just the main program. For an additional fee, attendees can get one more day of technical sessions presented by TAPPI’s PLACE Division – 14 speakers on topics such as plastic films, high-speed inks, ultrasonics, sustainability and supply chain collaboration.

The cost for both the June 10 TAPPI symposium and the Forum general program is $1,585 per person before May 15. The Forum program alone is $1,090. Discounts are available for company teams and consumer packaged goods executives. More information is available on the registration page at www.globalpouchforum.com

SIDEBAR

Global Pouch Forum 2015 Sponsors

Platinum: Ampac

Gold: Charter NEX, Mitsubishi, Sonoco

Silver: Allied Flex, Elplast, Hoffer Plastics, HQC, PPCTS/HCI, Zip-Pak, Atlapac Corp.

Bronze: H.B. Fuller, Presto Products