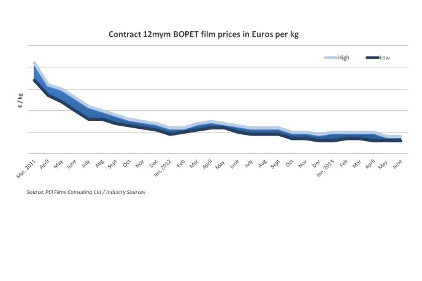

Following two years of steady decline in the European price of 12 micron bi-oriented polyester (BOPET) film, it would appear that the trend has finally stabilized. According to leading consultants to the industry, PCI Films Consulting (www.pcifilms.com), BOPET film prices have remained unchanged for three months running.

Whilst some modest reductions in price are likely for Q3, 2013, future price movements in either direction are not expected to be significant due to:

- Already squeezed film producer margins

- Excess film extrusion capacity

- Stable raw material costs

European film producer margins have been weakened in 2013 due to the absorption of higher input costs, mainly because they have been unable to pass these increased costs onto customers. In addition film producers have been chasing volume to improve capacity utilization at a time when European BOPET film demand remains at best stable. Both factors are putting BOPET film producers under significant financial strain.

Speaking of the problems facing the West European BOPET film extrusion industry, PCI managing director, Simon King says “European producers of 12 micron BOPET films will be glad to see prices finally stabilize but they still face strong competition from Turkish, Middle Eastern and Asian producers. European buyers of BOPET film now source the majority of their commodity films from lower-cost suppliers outside of Europe so if the European industry is to survive, successful strategies to develop and supply added-value products will be critical.”

In their latest edition of,European Monthly BOPET Film Pricing Series, PCI reports on industry average prices obtained from interviews with buyers and sellers of 12 micron BOPET film across Europe. As well as providing the industry with a unique and highly valuable monthly price index, the report also provides expert analysis and insight into the factors affecting prices during the month, such as fluctuations in raw material prices, demand across the supply chain and much more.