We published our 2020 Packaging Outlook at this time last year. And, well, the timing of that couldn’t have been worse. This thing that shall not be named really started affecting the world shortly thereafter.

The point is to take a cautionary approach with any predictions since events can change at any time, and these are the predictions based on what is expected to happen in the future right now. That last sentence was about as confusing as any Hollywood storyline related to time travel — hopefully you get the point.

The following compiled information comes from a number of research firms.

Packaging Machinery & Automation

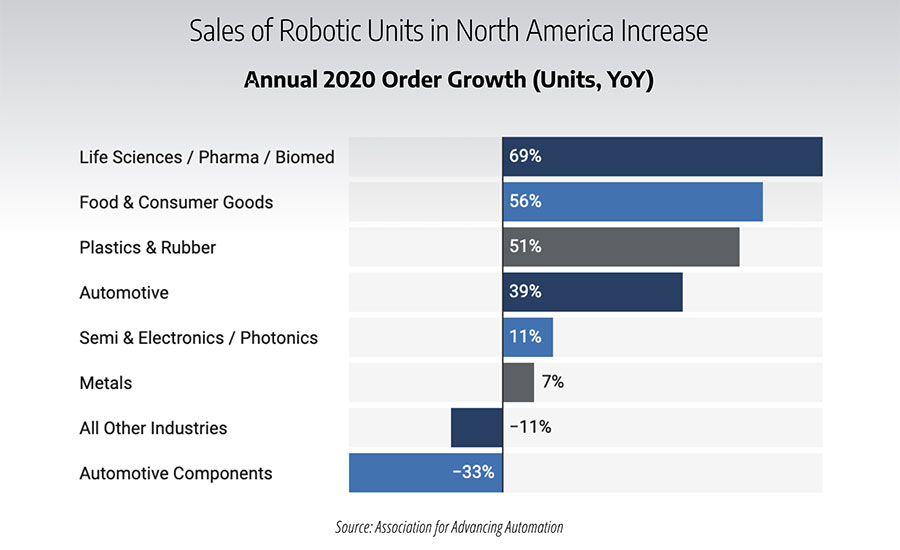

There has been speculation that the pandemic would spur U.S. industries to ramp up the automation of their operations. Others have said that U.S. industries were already doing just that. One study by the Robotic Industries Association (RIA), part of the Association for Advancing Automation (A3), suggests that the former is likely true. The organization announced last month that yearly orders of robots from non-automotive sectors surpassed automotive robot orders for the first time ever. Of course, the auto industry saw a steep decline in production due to the pandemic, unlike packaging which saw an explosion of e-commerce for the same reason. Whatever the reason, sales of robotic units in North America increased 3.5% in 2020 from 2019. This growth was driven by a strong Q4 that was the second-best quarter ever for North American robotic sales with a 63.6% increase over Q4 2019.

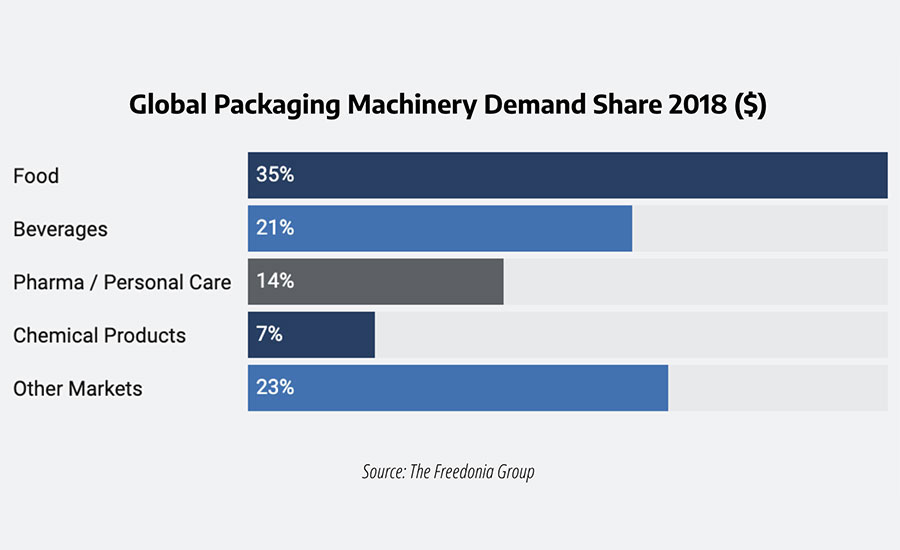

The Freedonia Group was predicting a 4.5% annual growth until 2023 in global packaging machinery demand according to an analysis that was done in early 2020, and a study done by Transparency Market Research published earlier this year is expecting about a 6% CAGR growth in the market through 2026. Driving that increase is food and beverage. “Exponential growth in the sales of packaged and processed food products in the last decade has led to increased demand for varieties of packaging solutions,” according to the report. Also fueling the increase are a broader CPG growth and the need for automated processes.

Market Research Future says the Asia Pacific region is expected to see the most growth in the packaging machinery market due to the number of food and beverage manufacturers, but North America is expected to grow significantly as well.

Paperboard and Corrugated Packaging

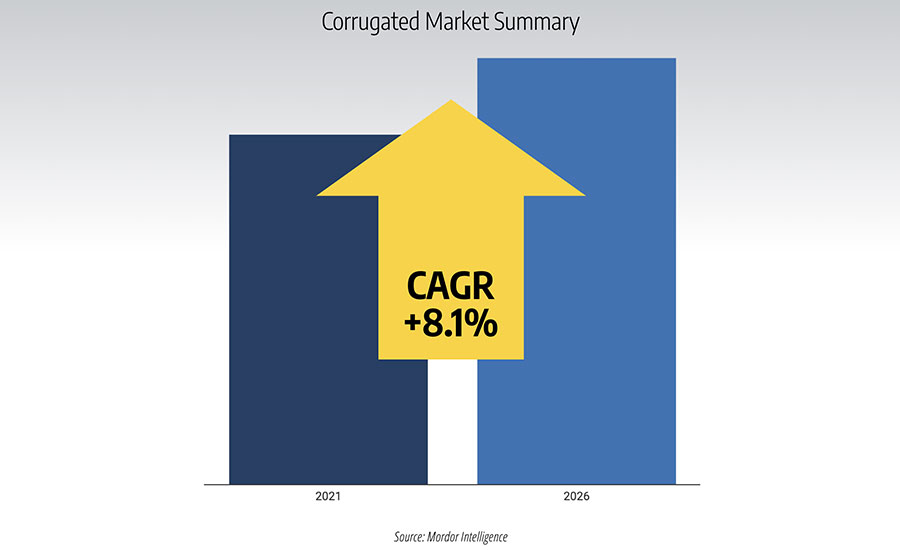

Mordor Intelligence reports that the corrugated board packaging market is expected to grow at a CAGR of 8.1% between 2021 to 2026. E-commerce, of course, is the driving factor behind that increase because of its versatility, cost effectiveness and other factors that make it appealing for e-commerce across the globe. The report also states that a survey conducted by GreenBlue found that 65% of respondents in the U.S. had concerns about plastic packaging, which gave corrugated a leg up due to its biodegradable properties.

An outlook report from Smithers mitigates those expectations a bit by saying, “softening of raw material prices between 2017 and 2020 have eroded the value of the market.” So while the research firm expects the market to grow, its expectations for how much the market will be work is lower. An element that it says is spurring the market is fit-to-product or box-on-demand systems, in addition to e-commerce, consumer demand and sustainability.

Paperboard is expected to grow at a CAGR of 3.5% between 2020 and 2026, according to Global Market Insights (GMI). The rising consumption of packaged food is a primary factor in the increase, as food and beverage already accounted for 50% of the market in 2019. And, again, sustainability plays a major role in its success.

Flexible Plastic Packaging

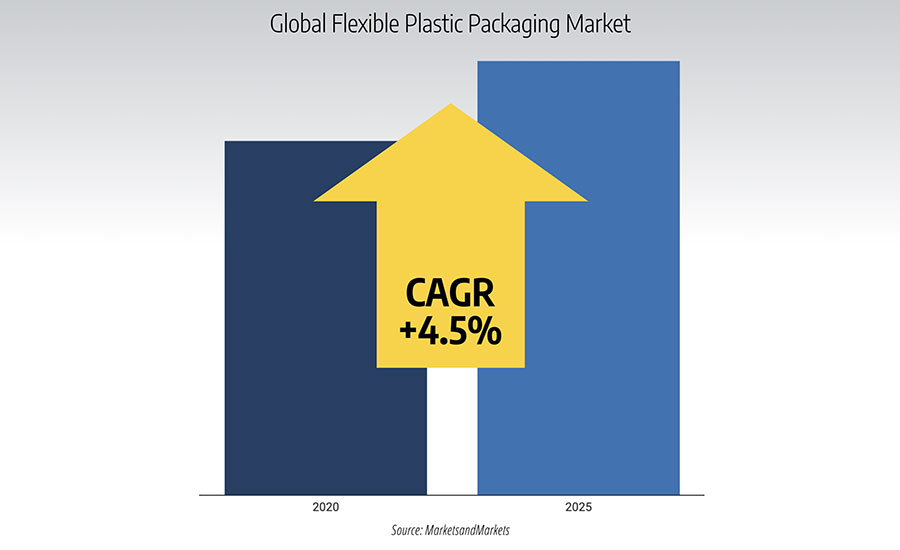

Food is again the segment making a splash, this time with the flexible plastic packaging market. According to MarketsandMarkets, the size of the global flexible plastic packaging market is projected to grow from $160.8 billion in 2020 to $200.5 billion by 2025 — a CAGR of 4.5% for the time period.

Pouches, of course, is the fastest-growing segment within flexible plastics packaging, again because of food. Freedonia is expecting demand in the segment to increase 6% annually through 2024, at the expense of rigid and other flexible packaging types.

MarketsandMarkets is expecting the barrier film market to reach $4.1 billion by 2025, growing at a CAGR of 5.3% between 2020 and 2025. The company says that market is witnessing high growth owing to demand for a longer shelf-life of food products, increasing demand for customer-friendly packaging and a rising number of retail chains in developing countries. The Asia-Pacific region is expected to register the highest CAGR for the period. PE is the major shareholder here, but the inorganic oxide segment projects to be the fastest growing due to its moisture barrier properties, transparency and cost-effectiveness.

Rigid Plastic Packaging

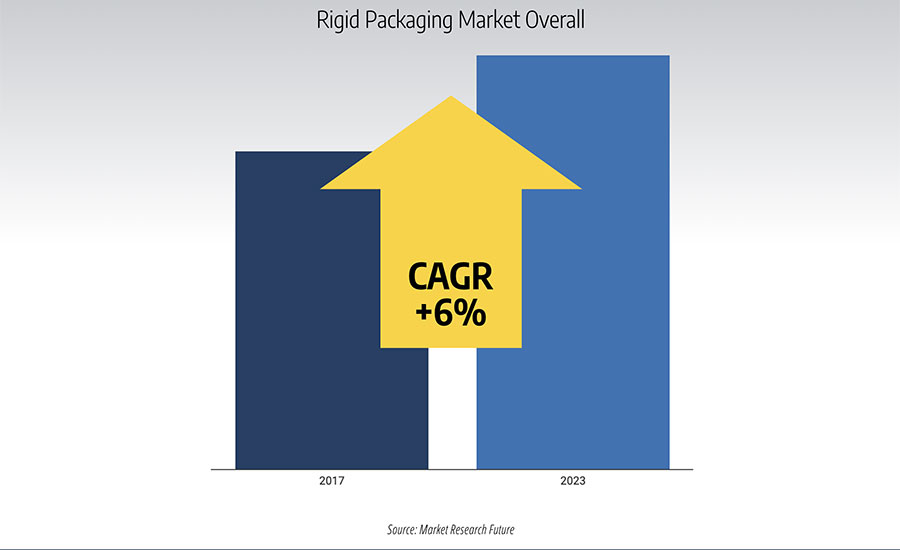

Valued at $248.8 billion in 2019, the rigid plastic packaging market is projected to reach $372.42 billion by 2027, according to Verified Market Research. Driving the CAGR growth of 5.6% between 2020 and 2027 is, again, food and beverage. Market Research Future also expects the same level of growth, and goes on to point out that the rigid packaging market overall is expected to grow at a CAGR of 6% between 2017-2023.

Consumer desire to buy products with environmental attributes is part of the success of rigid plastic’s increase due to its recyclability, but environmental concerns are also holding it back. Verified Market Research points out that the non-biodegradable properties of rigid plastic packaging have been reported to have a serious impact on the environment, which has slowed growth. Fluctuating raw material prices are also hindering growth. However, MarketsandMarkets reports that the plastics commodity market is expected to rise from $468.3 billion in 2020 to $596.1 billion by 2025 at a CAGR of 6.0% as plastics continue replace metals in the marketplace.

Glass Packaging

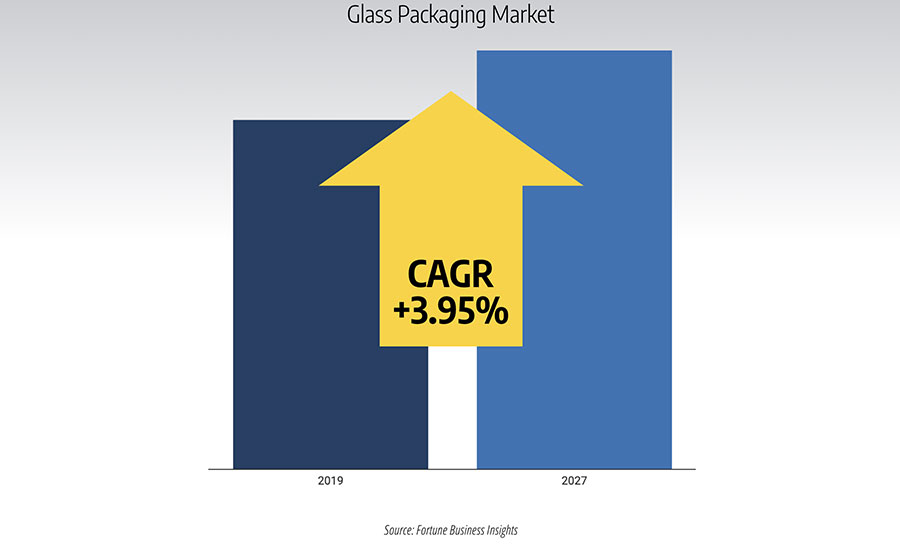

The glass packaging market is expected to increase, but that increase varies by research report. For example, Mordor Intelligence has it increasing at a CAGR of 4.39% between 2018 and 2026 to go from $56.64 billion in 2020 to $73.29 billion in 2026. Fortune Business Insights has the market growing from $60.32 billion in 2019 to $81 billion in 2027 for a CAGR of 3.95% during the forecast period. Meanwhile, Technavio is predicting a CAGR growth rate of almost 4% between 2020 and 2024. So, they’re all expecting an increase, but the question of which organization’s prediction pans out, if any of them, remains to be seen.

Where they all agree is the driving factor behind the growth: Every one of them sites glass’s well-known virtue of recyclability. Each research firm also makes note of the increase in consumption, led in this case by the beverage industry (which, in turn, is led by the alcoholic beverage segment).

The use of plastics is cutting into the growth of the glass market. The industry is attempting to mitigate those losses via coatings and other innovations to create shatter-proof glass containers.

Metal Packaging

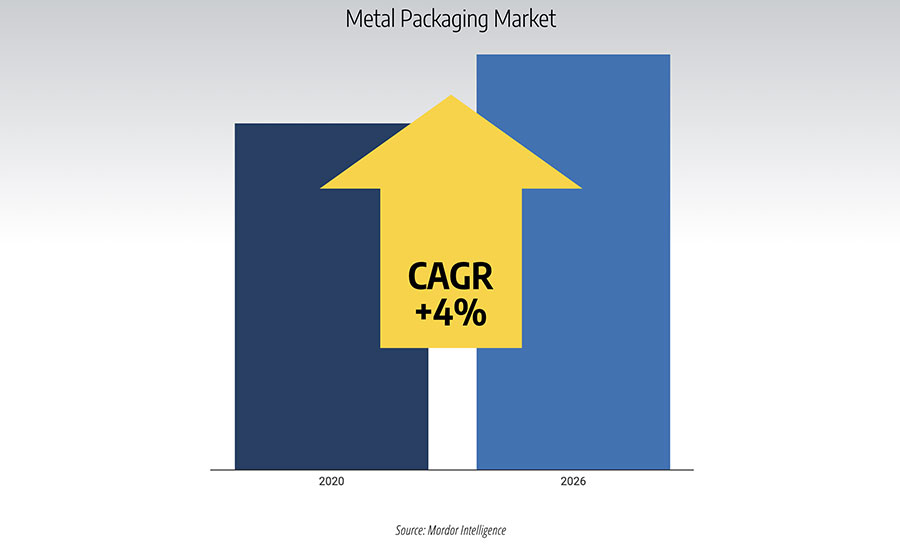

With many people staying in instead of going out to have a good time, beverage consumption has increased in the home. In turn, this has led to a shortage of aluminum cans. North America was already the largest consumer of metal packaging, “due to the fast-paced lifestyle leading to convenience packaging,” according to Market Research Future. These elements, coupled with the already-mentioned increase in food and beverage consumption overall, are the reasons why Market Research Future expects the market to grow at a CAGR of 3.36% between 2019 and 2025. Mordor Intelligence expects a similar growth rate of 4% CAGR from 2020 to 2026, which would take the industry value from $138.11 billion to $193.24 billion.

A report by Metabolic, commissioned by the Can Manufacturers Institute, found that aluminum cans have the highest circular performance compared with glass and PET bottles. Additionally, the report found that aluminum had the highest carbon emission reduction potential. Despite these reported benefits with aluminum, the overall market is still being held back. As Market Research Future states, “the growth of the market might be hindered by factors such as environment-related issues pertaining to steel mining and increased material cost.”

As plastics are cutting into the growth of glass, manufacturers of aluminum bottles are creating new products aimed at such industries as beauty, personal care, food and beverage where plastic currently holds the dominant market share.