The global flexible packaging industry enjoyed a strong year in 2017 with a sales growth rate once again significantly higher than U.S. GDP. All segments of the flexible packaging industry took part in this growth, but growth for value-added flexible packaging was even higher. Even under relatively flat or declining raw material prices, the industry revenues in 2017 grew at a healthy 4.1 percent. The growth in revenues for pouches grew at an estimated 7.9 percent, according to industry figures.

Executive Summary

- Stand-up pouches are the fastest-growing segment of flexible packaging with growth pegged at 7-9 percent per year to 2023.

- Smallest brands are growing fastest in the premium space.

- Trends toward digital print and converted flexible packaging distributors.

- Merger and acquisition activity continues unabated.

- Downturn in CPG growth—particularly foods and beverages—is having a negative effect on converters focused on large retail brands.

At the Global Pouch Forum event in Miami in June 2017, Sal Pellingra of ProAmpac (proampac.com) gave a very interesting perspective on the growth of flexible packaging in general, and pouches in particular. According to numbers generated by a Harris Poll chartered by the Flexible Packaging Association, 83 percent of all brand owners are currently using flexible packaging of some type. In addition, 26 percent of all brands have increased their usage of flexible packaging in the past five years, and 31 percent intend to increase their flexible packaging usage in the next five years.

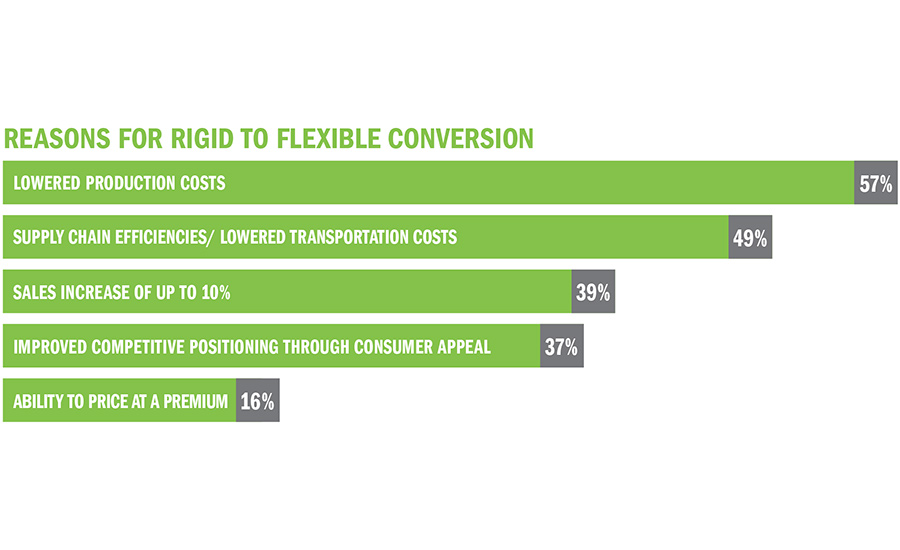

This is all very good news for the flexible packaging industry, but the same Harris Poll unearthed some even better news. Flexible packaging is replacing rigid packaging for good reasons, primarily because of lower overall production costs and better supply chain efficiencies, but also because of increased sales and consumer appeal. Said another way, flexible packaging is a lower cost, higher value option than rigid packaging.

The other interesting macro trends that support the growth of flexible packaging come from Mintel’s (mintel.com) “Global Packaging Trends 2018” report that provides a look at the challenges and opportunities that will impact manufacturers, brands, and retailers across packaging markets around the world.” This report was authored by packaging industry veteran David Luttenberger.

Luttenberger’s report highlighted these five trends:

- Packaging will play a pivotal role in reducing global food and product waste.

- Online brands will reinvigorate their packaging to enhance the e-commerce experience.

- Brands that adopt clear and succinct package messaging will be rewarded as consumers prefer brands that embrace minimalism.

- Brands will be called to keep marine conservation at the forefront of packaging development and to anchor the circular economy for future generations.

- Contemporary packaging formats will see the center-of-store take center stage.

Flexible packaging addresses each of these trends very well. Let’s take a look:

WASTE

Flexible packaging is widely used in every type of food delivery format from extending the shelf-life of fresh fruits and vegetables to reducing the package weight of aseptic milk. In addition, flexible packaging is a key component of most of the packages using the rapidly expanding high-pressure pasteurization technology for minimally processed foods such as fresh-pressed juices and wet salads and sauces.

E-COMMERCE

Use of flexible packaging in e-commerce shipping allows for much lighter weight packaging as well as packaging designed specifically for the rigors of small package transport. Shipping containers with special built-in air pockets can support hard to ship products, plus pouches can be used that hold up very well to air pressures and dropping through the logistics channels.

PACKAGING MESSAGING AND MINIMALISM

Consumers have shown time and again that they prefer the ability of flexible packaging to deliver the message of a brand. The bright graphics, clear windows or matte finishes, unlimited functionality, and ease of incorporating active and intelligent features into pouches in particular, are used to convey clear messages about the products inside. In addition, the dramatically lower carbon footprint of flexible packaging communicates the intentions of the brand.

MARINE CONSERVATION

PepsiCo and Danimer Scientific (danimerscientific.com) co-developed a liner of biodegradable resins appropriate for use in films for PepsiCo’s global food and beverage businesses. The

technology is an expansion of Danimer’s PHA polymer chemistry. In addition, degradable resins and films have been developed for use in coffee pods, overwraps and shopping bags. Also, P&G has licensed its polypropylene recycling technology to PureCycle Technologies (purecycletech.com) to produce high quality recycled PP with properties purported to be similar to virgin resin.

CENTER-OF-STORE

Pouches have already become the star in the replacement of traditional glass and cans in the center of the stores. Pouches for soups, sauces, dressings, baby food, nuts and fruit juices have been around for many years. Newer pouched products include pickles, olives, tomato paste, vegetables, beans, sour cream, yogurt, and even sauerkraut. Every brand owner or market manager must be considering flexible packaging options if they are not in pouches already.

WHY THE POUCH?

Convenient

- Easy opening (e.g. tear notch, laser perforation)

- Easy to use (e.g. zipper, shapes)

- Lightweight

- Reclosable

- Microwave or traditional oven

Fresher perception

- Preservation of flavor, texture, mineral and vitamins

- “Dialed-in” barrier as needed

- Extended shelf life

- Product visibility: clear windows, walls, gussets

A couple of shining examples of a brand company launching new flexible packaging in 2017 are Bare Bones Broth and The Brew Company. Both of these companies launched as small, regional brands, but both used innovative flexible packaging to expand their businesses and grow beyond their regional presence. Bare Bones launched their line of all-natural broths and broth blends in a plastic tub sold in the freezer aisle. The owners struggled to position the product in a way to stand out. They moved to a pouch, again sold in the freezer, but at least sold as a hanging package. Their most successful change was to develop a shelf-stable stand-up pouch with a screw-top cap that is now sold on the same regular grocery aisle with other cooking stocks, broths, and soups. Bare Bones Broth can now be found across the U.S. in specialty and mainstream grocery stores.

The Brew Company developed their business model around their excellent line of coffees and teas taking complete advantage of the functionality of a flexible, fitmented, double-chambered pouch to allow their consumers to brew their beverages on demand and on the go. The patented design holds the ground coffee or dry tea in a built-in filter mounted inside the pouch. The consumer pours hot water through the reclosable top of the pouch, and the water filters through coffee or tea to precisely brew the beverage. Then they open the small tap and easily and safely pour the hot brewed beverage into their cup.

Several trends continue to develop in converting of flexible packaging, including:

- Digital printing: Bemis, Printpack, Sonoco, ePac, Swiss Pack, many others

- New pouch and lidding functionality: breather films, press-to-close, double gusset pouches

- Simplified supply chains: vertically integrated plants, print/laminate/pouching

- New channels of distribution: TricorBraun’s acquisition of Taipak Enterprises

NEW FLEXIBLE PACKAGING

Once again in 2017, a number of new products were introduced that supported the innovations in flexible packaging. One award-winning package was from Flex Films (flexfilm.com), for a pouch for fresh-cut flowers that keeps the flowers fresh in a closed pouch with engineered film that allows the package respire during transportation. Plastic Packaging Technologies (PPT) (plaspack.com) developed a 5.25 lb. box pouch for dry window washing solution that can be mixed in the pouch and used onsite. ConAgra’s Hunt’s tomato paste was launched in a simple, 2-teaspoon portion pouch for home use. ProAmpac helped solve the challenge of shipping true sauerkraut by developing a pouch with a gassing valve and zipper for a 16-oz. stand-up pouch.

INDUSTRY PLAYERS

The merger and acquisition activity in the flexible packaging market in 2017 can best be described as frenetic, with most of the larger players having at least some level of activity. Sealed Air Corp. (sealedair.com) completed the divestiture of its Diversey chemicals business, an acquisition made only five years ago. The two companies never really meshed, so any potential synergies were never gained. Sealed Air believes that refocusing its business on its core markets of protective and food packaging will offer market opportunities. Sonoco (sonoco.com) was particularly active in 2017, closing on its purchases of Plastic Packaging Inc. and Clear Lam Packaging. These two acquisitions support Sonoco’s growth in shorter run business as well as innovative new markets.

Perhaps the most surprising deal in 2017 was one that was rumored but never consummated. Bemis (bemis.com) has had financial struggles recently as it tries to work through corporate right-sizing due to shifting dynamics with the large CPGs it supports. Bemis has announced the closure of two plants in Illinois and Tennessee, but the biggest news was a potential deal with Amcor Ltd. This deal, should it come through, would be felt through the entire industry, as spin-offs would almost certainly need to occur to satisfy antitrust regulators. Bemis has not confirmed that any deals are in the works.

Private equity made its mark as well, with Oak Hill’s acquisition of Charter NEX Films (charternex.com), Pritzker Private Capital’s bolt-on acquisitions of Clondalkin Orlando, PolyFirst Packaging, and Trinity Packaging onto its existing ProAmpac business, and Morgan Stanley Capital’s acquisitions of Fisher Container and Packaging Products Corporation.

Significant expansions were announced or completed by Printpack, American Packaging, Kendall Packaging, Gateway Packaging, and ePac LLC. The strategic focus of ePac is to open a series of smaller footprint, lower-output plants, each with digital printing and some lamination capabilities. Plants are already open in Middleton, WI and Boulder, CO, with a plant to be opened in the Los Angeles area in 2018. In addition, ePac and Karlville, a supplier of flexible packaging manufacturing equipment, have announced an agreement to build a plant in Miami to serve the southeastern US and into Latin America.

|

Packaging Outlook 2018 articles:

|