U.S. private label brands have seen $143.4 billion in sales over the year, a figure up nearly $14 billion since 2015, according to Nielsen. In comparison, store brands have grown 3.7% since one year ago; and name brands have grown by 1.9%. Today’s consumers are more willing to splurge for store brands than they would for name brands. In fact, 40% of Americans say they would pay the same or more for the right store branded product, while just 26% feel that name brands are worth the extra price.

I recently spoke with Todd Maute, partner at brand strategy and design agency CBX, to get a glimpse into how store brands continue to grow and differentiate themselves from larger national brands.

Maute says that private label brands are outpacing national at 33% of volume up over the last five years. Growth drivers include retailers expanding their portfolio of products, such as organic items (gluten-free, meal replacements, perishables), and understanding consumer needs. “One of our customers is hiring 60 people just to look over private brands,” he says.

Retailers are realizing that consumers can buy national brands anywhere, but for their in-store brands, consumers can only find those at their store. As well, retailers who have higher private brand penetration boast more consumer loyalty.

Private brands do not drive topline sales gross like public companies do because pricing strategy is cheaper than national brands — but the bottom line profitability grows.

How to Stay Relevant

One thing that has helped growth, says Maute, is innovation on the manufacturers’ side, working with, and therefore helping, private brands. Kroger, with its Simple Truth food brand and Bromley’s line of men’s personal care products to name just a couple, is innovating. The retailer launched its men’s care line, but Harry’s and Shave Club has taken over this market. Kroger though, launched its own e-commerce site for its brand just to compete with Harry’s and Shave Club. The retailer looks at consumer trends and proactively addresses them. “Consumers shop by category, and retailers need to think the same way,” advises Maute.

When asked how stores can stay relevant, Maute explained that with more data and insight, retailers are becoming more sophisticated and realize they have control of the environment (such as product selection) and merchandising strategy, as well as understanding the motivation of consumers by category. For example, purchasing in the soft drink category is different than looking at products in an over-the-counter pharmaceutical category. Maute adds that it starts with a foundational understanding of “Who’s my customer? Who do I want in my store?” And packaging design and merchandising impact those things.

Some retailers are also hiring CPG-minded people and working with agencies and partners to manage the brands for branding, advertising, packaging design, etc. on a brand-by-brand basis.

For instance, if Trader Joe’s brings in a new product and it doesn’t sell, they get rid of it and try out another product. Most people don’t look at Trader Joe’s as being private label, though about 90% of its products are indeed so. Every product and strategy at TJ’s has a story for the consumer’s store experience. “Trader Joe’s has other nuances such as cool shirts worn by consumers, neat décor, cool products and merchandising … everything they do is telling a story, down to the private brands they offer,” says Maute. “It is a very well-aligned strategy from who they are as a retailer to the consumer.”

With a little more sophistication and commitment to brand management, private brands can only grow, supply and product development continue to get better and innovation continues to grow. Grocery is changing too — the store perimeter is being shopped more and center store continues to shrink. As private brands move from the center store, they need to expand to the perimeter, where consumers are spending more time. As long as they stay on top of what’s most important to the customer, private brands will flourish.

The effect that ecommerce has on private label brands can be positive, as long as there is an “order online and pick up in store” method or the retailer has an ecomm channel. “E-grocery will continue to grow, especially as new generations get older. Category by category as the operations and supply chain become better, categories will shift online,” explains Maute.

Premium Private Label

The rise of high-end store brand products comes hand in hand with consumers spending more on these brands. Nielsen analyzed individual UPC price points and created a five-tier distribution that separates the most premium- and discount-oriented groups of products. Discount products still represent the majority of store brand sales in America, but they have ceded three share points in the last three years. Premium tiers of private label products have grown in this time, now representing over 19% of sales.

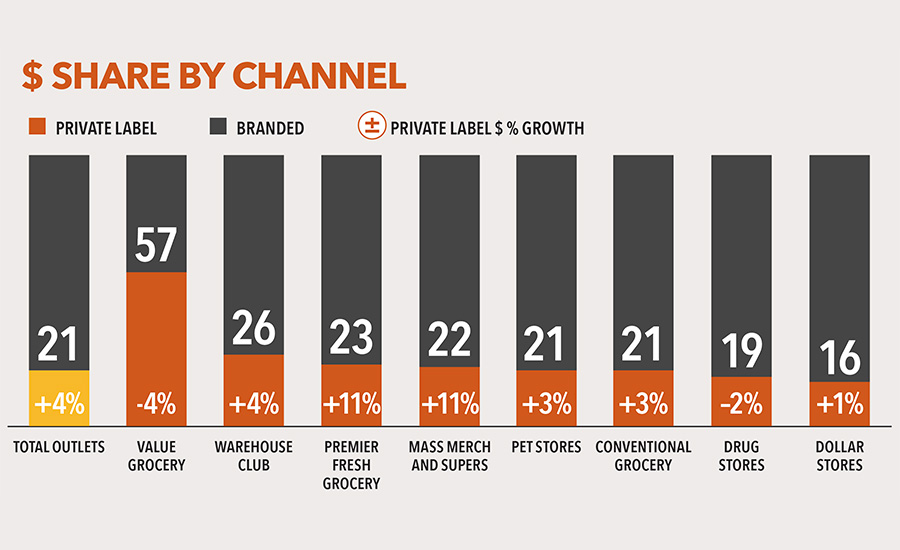

With a premium makeover to many private label products, there has been an impact on discount grocery stores. U.S. value grocery outlets, including ALDI and Lidl, have collectively seen a 4% decline in private label share. Stores with premium products, like fresh grocery stores Whole Foods, Trader Joe’s and Fresh Market, have continued to see growth in private label sales.

European discount retailers also are seeing the shift away from their store brands. Drawing global comparisons to markets where store brand presence has matured, name brands have driven over twice the CPG growth for discount retailers in Europe compared with store brands. Mature discount retailers in Germany have seen 10% sales growth from name brands in the last two years, far outpacing the 1% in growth experienced by store brands there. In these instances, name brands are a source for differentiation and driving new demand for discount retailers. This could create a new and profitable home for many name brands that have yet to tap the world of discount retail.

Award-Winning Packaging

Winners of the Private Label Manufacturers Association’s 2019 Salute to Excellence Awards have been chosen and from the results, it’s clear that retailers are relying on innovations in store brand products and packaging to attract and keep shoppers.

PLMA’s annual awards program spotlighted this trend, from more than 750 store brands food and nonfoods products submitted by 62 U.S. and Canadian retailers. Eight panels of industry professionals and consumers evaluated the products. There were 44 food and 23 non-food winners, including gourmet & indulgence, products for healthy eating, plant-based, sustainably sourced and organics on the food side, as well as “free-from,” eco-friendly and more in nonfoods. For the full list of award-winning products, visit plma.com. A few highlights include:

FOOD & BEVERAGE CATEGORY

- Almond Butter, by Thrive Market

- Good & Smart dried apricots, by Dollar General

- Veggie Spirals, Meijer

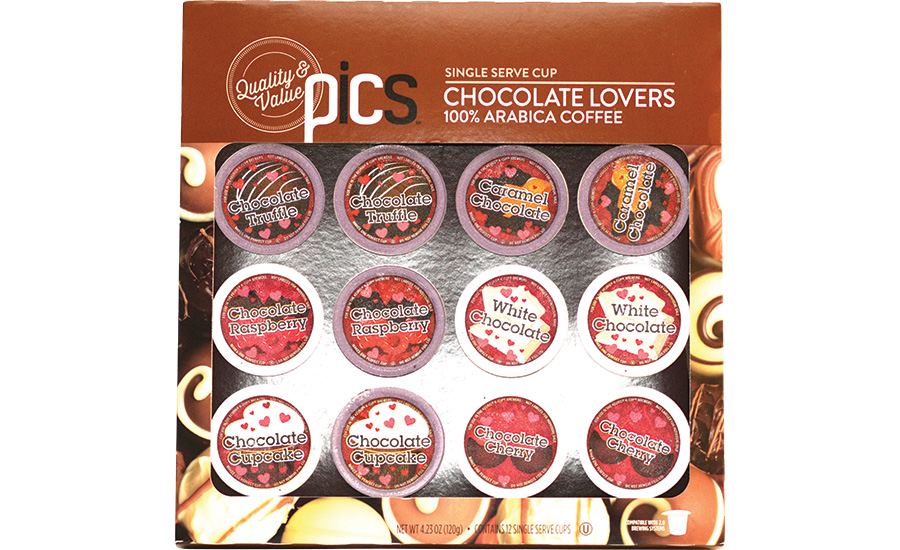

- Chocolate Lovers coffee pod assortment, PICS, Price Chopper

- Black Sesame & Ginger Turkey Jerky, by Private Selection, Kroger

HOME & BEAUTY CATEGORY

- Kids 3-in-1 watermelon shampoo, conditioner, wash, by Equate Kids, Walmart

- No. 03 Beard Oil, by Goodfellow & Co., Target

- Cucumber Mint Refillable Glass Cleaner Starter Kit, by Brandless

- Rosemary and Mint Dish Soap, by Bee & Willow Home, Bed Bath and Beyond

- Cavity Fighting & Whitening Flouride Toothpaste, by 365 Everyday Value, Whole Foods Market

|

Private Brand Design Trends Daymon, a leading private brand consultant, shares in its Private Brands Intelligence Report 2019 that 85% of consumers trust private brands as much as national brands; 81% buy private brands on every or almost every shopping trip; and 53% shop at a store specifically for its store brand.

Making sure brands are visually on trend will help with on-shelf appeal, make them easier to shop and help to elevate the quality perception of the product. Daymon’s top five design trends that impact private label brands are:

|