It is a new year — with a new Congress, and many new state legislatures — but the same trade wars and scrutiny over packaging and plastics exists; so, what is the outlook for flexible packing in the U.S.? Still strong and growing.

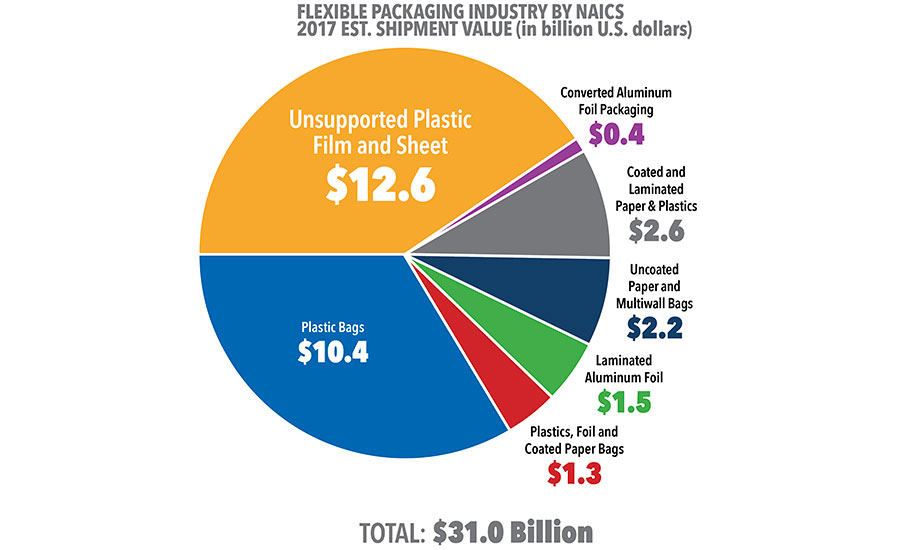

The flexible packaging industry is estimated to be $31 billion in annual sales using Flexible Packaging Association (FPA) 2017 data. Since its development, flexible packaging has maintained steady growth; and over the last 10 years, its share of total packaging in the U.S. increased from 16 percent to its current rate of 19 percent. Flexible packaging is the fastest growing segment of packaging in the U.S., as well as globally.

Trade continues to dominate the landscape for aluminum foils used for a variety of flexible packaging applications, with not only steep tariffs on imported foil from China, but on a myriad of other products FPA members import from other countries, such as Mexico, Canada and European nations. New tariffs on imported goods were met with retaliatory tariffs on exported goods, with little end in sight.

While FPA is hopeful that at least some of the tariffs (and retaliatory tariffs) will be removed with the ratification of the United States, Mexico and Canada Agreement — which will replace the North American Free Trade Agreement — with the divided Congress, ratification is not guaranteed. FPA will continue advocacy efforts both on its own and through trade coalitions to try and secure that ratification.

The backlash against plastics, particularly plastic packaging, increased in 2018 as well, in part due to pressure from the European Union and media outside the U.S. However, this sentiment manifested itself in both voluntary and mandatory straw bans in the U.S., and is a sign of more plastic bans to come. As flexible packaging, particularly multi-material laminate flexible packaging, is not readily recyclable and generally contains plastic, our industry is a part of the conversation. In fact, together, sustainability and recycling/end-of-life topics about flexible packaging made up 14 percent of online flexible packaging conversations in 2018, which is double that of 2017.

This year, the state of Washington introduced legislation to mandate an extended producer responsibility program, where consumer product companies take financial and operational responsibility for the end-of-life management of their packaging. This is the first legislation of its kind in the U.S., and goes far beyond that of programs already in place in Europe and Canada. FPA opposed this legislation, and while unlikely to pass this year, it sets a precedent for other states — such as Rhode Island, which had a “Taskforce to Tackle Plastics,” slated to give recommendations to the governor in February.

Despite these headwinds, flexible packaging continues to grow — with a 2.6 percent growth rate in 2017, and projected growth rates in every category but one that FPA tracks: beauty and personal care; beverages, dog and cat food; food; home care; tissue and hygiene; and tobacco, which is the only category that is projected to decline.

In the food category, every segment is projected for growth: baby food; biscuits and snack; dairy; process fruits and vegetables; process meat and seafood; ready meals; sweet and savory and snacks; and soup. This is because flexible packaging is typically more sustainable when compared to other packaging options.

A recent report commissioned by FPA, “A Holistic View of the Role of Flexible Packaging in a Sustainable World,” includes life cycle analysis of traditional packaging types versus flexible packaging, and shows favorable environmental outcomes for flexible packaging when looking at water and energy usage, greenhouse gas emissions and material to landfill at end-of-life.

For example, a rigid PET container for laundry detergent pods emits +726 percent more greenhouse gases than a stand-up pouch with zipper; a single serve juice pouch efficiently uses packaging with a 97:3 product-to-package ratio; and even when assuming a 71 percent recycling rate, a steel coffee can results in about four times as much material landfilled as waste versus the stand-up flexible pouch.

These are only some of the reasons why flexible packaging is strong and growing despite many obstacles. There are several end-of-life management initiatives that FPA and other industry organizations are working on together to address the concerns over plastics in the environment. FPA sponsored a community-level pilot, known as the Hefty EnergyBag Program, in Citrus Heights, Calif., to prove waste to energy is a viable option for managing flexible packaging solid waste. Its success led to pilots in other parts of the country including Omaha, Neb.; Boise, Idaho; and the latest program in Cobb County, Ga.

FPA is also a partner in an industry-sponsored multi-year research project, Materials Recovery for the Future (MRFF). The overarching goal of the program is to find the most cost-effective pathway to separate at scale and create a flexible packaging commodity bale for reprocessing or conversion to fuel or energy feedstock.

The sustainability benefits and activities surrounding solutions for the end-of-life management of flexible packaging enable consumer product companies using flexible packaging to meet consumer demand for sustainable and convenient packaging. And this is why the packaging segment is growing and expected to continue to grow in the foreseeable future.

Packaging Outlook 2019 Articles:

|