Packaging is constantly changing, and to keep up with consumer and retail/CPG demand, we have to look at the future as “now.” Thinking ahead in order to forecast and make predictions on what will trend and how machines and materials can be used in the foreseeable future is one way to help stay ahead in the ever-changing market.

As part of PMMI’s Vision 2025 focus groups at PACK EXPO International last fall — which included CPGs, OEMs and contract packagers — one thing resonated: Mass Customization. This is described as consumer and customer demand and the operational tactics for fulfilling them, i.e. driving consumer packaged goods manufacturers toward “mass” efficiencies along with competitive advantages of customization.

This report includes analyses of and forecasts for the flexible plastic, rigid plastic, folding carton & corrugated container, metal and glass packaging segments, as well as packaging machinery for 2019 and beyond. Industry experts and influencers share their views on what is ahead for each sector.

Packaging Machinery

Minimizing machine footprint and shrinking bulky control cabinets, or eliminating them entirely, has become a top solution for many. Machinery now comes smaller, faster and in a more-open layout for ease of use, maintenance and simple changeover. This serves both plants with large production lines, and even smaller facilities with less space. Sanitary equipment such as processing machinery, conveyors and filling equipment, has become turnkey with simple solutions to quickly and easily wash down units for less downtime as well as curved corners, special doors and more to ease the process.

PMMI’s Global Packaging Study reveals that the global packaging machinery market was worth $36.8 billion in 2016 and is forecast to reach 42.2 billion by 2021 at a CAGR of 2.8 percent. Reasons for growth include population rise, growing middle class, added sustainability concerns, more spending power in developing regions, increased popularity of flexibles (specifically pouches), demand for smart packaging solutions and serialization to combat counterfeiting.

The leading machine groups have been filling and dosing machinery at 20.7 percent and labeling, decorating and coding at 12.6 percent. The machine groups to grow the fastest to 2021 are horizontal form, fill and seal at 3.2 percent; fill and seal at 3.1 percent; and labeling, decorating and coding at 3.0 percent.

The food sector is the largest driving the global market at 40 percent, beverage at 30 percent, other sectors at 30 percent and pharmaceutical at a mere 4.1 percent — though it is again the fastest growing.

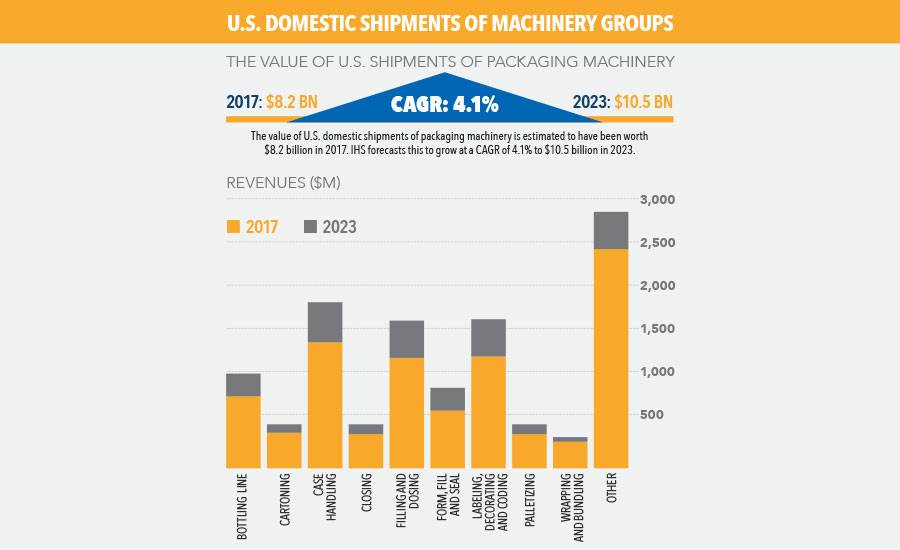

In the U.S. alone, the value of shipments of packaging machinery was $8.2 billion in 2017, with an expected rise to $10.5 billion by 2023 (IHS Markit). Horizontal FFS will see the fastest growth at 5.3 percent growth to 2023.

The breakout of machinery by sectors reveals that food/nutraceuticals at 36.6 percent of shipments followed by beverages at 22.0 percent.

Automation

Automation can be seen in new areas including warehousing. Look up and you may see a drone taking a package from one end of the line to the boxing area at Amazon.

According to the “Automation in CPG Companies” survey by PMMI conducted last fall, as automation importance and use increases, collaborative robots (cobots), artificial intelligence and big data can be three distinct drivers of investment and performance.

Those that are utilizing automation — particularly in the packaging sector — have seen a competitive advantage over those taking a “wait and see” approach.

Six trends driving plant floor automation are:

- Lack of skilled labor or labor shortages;

- Global increase in product demand;

- Rising demand for flexible manufacturing;

- Producing products with consistent quality;

- Overall operating cost reductions; and

- Smart machine technology and cobots.

The International Federation of Robotics (IFR) forecasts growth of about 15 percent for 2018–2020. Stronger-than-expected growth in the global economy, faster business cycles, greater variety in customer demand, and the emergence and expected scaling up of Industry 4.0 concepts are driving the forecast.

The fastest growing segment of industrial automation, however, is cobot use — with an expected jump to 34 percent of all industrial robot sales by 2025, according to the IFR.

While growth is projected, PMMI’s survey found cobot use in packaging remains relatively low with just 10 percent claiming adoption. However, of those that are embracing the technology to address workforce and efficiency, 86 percent report an increase in productivity. Within that 86 percent, nearly one in five users indicate significantly increased productivity. From a return on investment point of view, 78 percent report that whether it be a decrease in labor cost or an increase in output, cobots directly increase their company’s earnings.

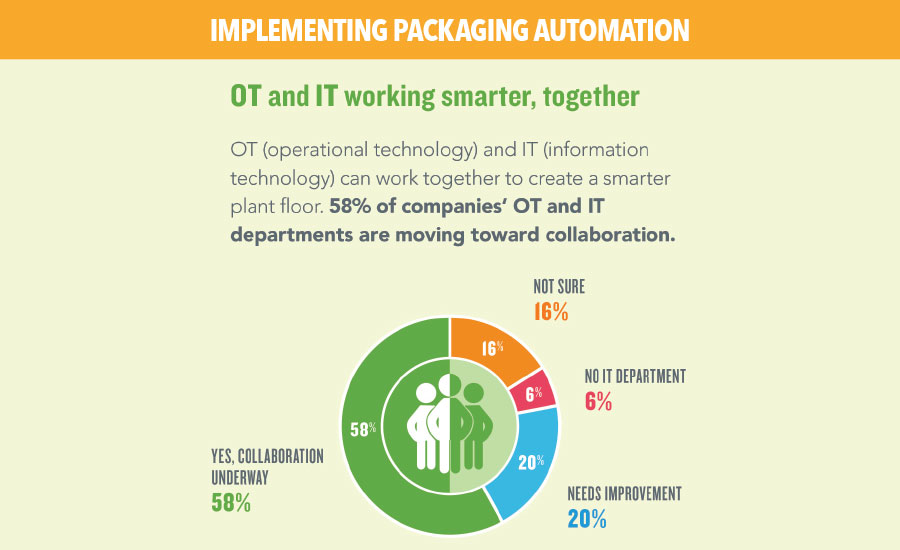

With regard to implementing automation, operational technology and information technology should work together. The automation survey by PMMI shows the industry agrees on the needs for standards in:

- Communications protocol: 81%

- Control systems: 42%

- Safety systems: 35%

- Data collection: 31%

- HMI: 27%

- Cleanability: 27%

- Parts: 17%

Artificial intelligence (AI) is one significant attribute driving cobot use, freeing robots from guarded situations to allow them to work closely to humans. In addition to its use in cobots, 63 percent of PMMI’s survey respondents using AI believe it’s essential to their ability to address challenges on the packaging line.

Smart glasses are another way operators are allowed to be hands-free yet able to interact with their environment. Augmented reality technology allows users to see digital imagery overlaid onto the physical world — meaning, operators can see how to change out or fix an error quickly, instead of calling for maintenance or looking it up in a manual.

Emerging software automation includes digital twin (digital tool bridging the gap between digital and physical worlds), remote machine monitoring (software and hardware systems enable OEMs to employ remote access to data) and digital or reality modeling (3D modeling for plant layout, design and more). Each of these has merit and is being used currently.

Packaging Outlook 2019 Articles:

|