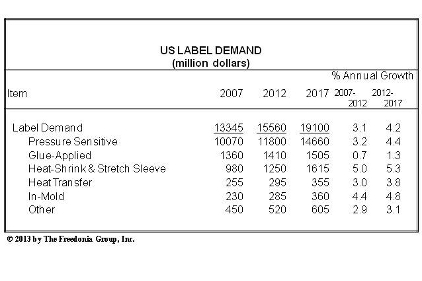

Label demand in the US is projected to climb 4.2% annually to $19.1 billion in 2017. While the dominant pressure sensitive segment will enjoy healthy advances, it will face growing competition from alternative labeling methods for primary packaging, such as heat-shrink and stretch sleeve, and in-mold labels. Heat-shrink labels will experience the fastest gains through 2017, with increases attributable to their ability to form-fit contoured containers and their strong visual appeal afforded by 360-degree graphics and maximum promotional area, enabling consumer products to stand out in a crowded marketplace. Glue-applied labels, despite their lower unit costs and speed of application, will face further loss of share due to competition from higher performing labels, especially in key markets such as beer and wine. These and other trends are presented in Labels, a new study from The Freedonia Group, Inc. (www.freedoniagroup.com), a Cleveland-based industry market research firm.

Flexography is the leading label printing technology due to its versatility, low cost, and suitability for use in the large pressure sensitive segment and the faster growing sleeve label segment. However, digital printing will experience double-digit annual advances through 2017 as it continues to displace traditional methods such as lithography and flexography.

Primary packaging accounts for by far the largest share of label demand. Though growth in this segment will slightly trail the overall average, gains will be supported by the importance of labels in differentiating products at retail and influencing consumer purchasing decisions. Secondary labeling and labels used in mailing and shipping applications are projected to achieve the fastest growth through 2017.

Paper will continue to account for the majority of label stock over the forecast period based on its cost advantages and the ability to be coated for enhanced durability. The use of higher-end materials -- such as metallic and holographic papers -- will also promote value growth. Plastic stock will continue to capture share from paper in a broad range of label applications based on aesthetic and performance advantages, along with a shift in the overall packaging product mix toward plastics. The popularity of the no-label look will also bode well for plastic labels. By 2017, plastic will account for more than 30% of label demand in value terms.