Unless a package is particularly hard to open, such as the plastic clamshells that imprison electronics, the first time most consumers consciously consider packaging is when it’s empty. But by the time they toss it away (hopefully into a recycling bin), the package has served myriad roles — most underappreciated — in the food and beverage value chain.

The principal role of food packaging seems so obvious: protection from physical harm, spoilage and food-borne pathogens as it extends the shelf life of food in its processed state. But there are many more roles that are not top-of-mind to food and beverage manufacturers — yet they should be, as they impact almost every facet of their businesses, including the bottom line.

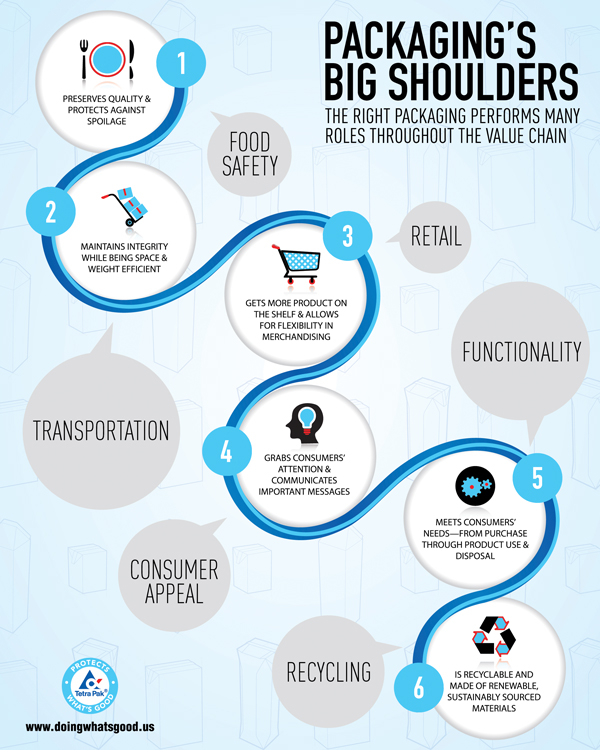

Smartly designed packaging has big shoulders. Among the many burdens it carries are: maintaining food safety, preserving product quality and eliminating food waste; communicating product positioning and providing consumer information; simplifying a retailer’s work and expanding where products can be sold; increasing functionality in the hands of consumers by facilitating ease of use; and finally, enabling recycling and end use.

PACKAGING AS CORNERSTONE

Packaging is a logistical cornerstone, facilitating interactions between supplier, producer, retailer and consumer. Decisions about packaging type can determine the success or failure of a product, with repercussions that affect every link in this interactive chain.

For example, choosing to put milk in a package that is heavy, breakable and must be refrigerated will yield dramatically different results in terms of transportation costs, sustainability and waste compared with one that is lightweight, sturdy and shelf safe for several months at ambient temperatures.

These choices impact retailers and brands, especially because there are already formidable shelf-space struggles in the centers of stores and even stiffer competition for cooler space. Trim, space-maximizing, shelf-safe packages offer more flexibility than those requiring refrigeration or freezing, in that they can be delivered in larger amounts, less frequently and be displayed anywhere. This last benefit supports retailer co-location strategies, making it possible to sell juice near liquor, for example, or milk near cookies.

CONNECTING WITH CONSUMERS

Although packaging choice can have significant logistical impacts between producers and retailers, it is with the consumer where packaging carries its heaviest burdens. It affects every aspect of a consumer’s interaction starting with whether the shopper notices it on the shelf and how that package communicates the product’s positioning, flavor appeal and increasingly important nutritional content. What’s more, by using QR codes and other package stamping, consumers can find out additional information about where their food comes from, how it was produced and, in the event of a food safety concern, get immediate assurances about whether their product is part of a recall. Some companies have begun using this kind of information as marketing, including Colorado-based Aurora Organic Dairy, which touts “cow to carton” traceability on its website.

Once the package is chosen off the shelf, the shopper has made the commitment to carrying it home. To help earn the package’s place in the cart, lighter is always better, and not just for the growing number of commuting urban shoppers, who invariably appreciate a lighter bag. Parents and older shoppers also appreciate lighter weight loads.

After a product makes it home, the potential for a repeat sale can be helped or harmed by how easy or convenient the shopper finds its use. As select producers get more creative and pour more effort into package design, functionality — in terms of size, shape and usability — is an increasing differentiator for many product categories. We know from our own experience that enhanced functionality has the potential to help brands not only increase market share but also grow a category.

Incidentally, size does matter. Brands offering convenience sizes connect with two growing trends: the smaller household with one to two individuals1 and the grab-and-go market.2

PACKAGE END-USE

Finally, we come to end-use: What happens after the product is used and how the package is disposed can have a significant impact on consumer attitude about that product.3 More than half (56 percent) of consumers want more sustainable packaging choices, and 46 percent are willing to pay more to get them, according to a recent survey by Asia Pulp and Paper, as cited by Greener Package magazine in the article “Top Five Packaging Trends for 2015.” Finding out a package cannot be recycled can create feelings of guilt or remorse in sustainability-conscious shoppers and negatively impact the likelihood of repeat sale. Environmentally active consumers, in fact, consider packaging as part of a product’s value proposition, and some 37 percent routinely search for recyclability labels, as our biannual survey found.4

This cohort notices factors such as whether a package is made from renewable resources, if it includes post-consumer recycled materials and if the package can be recycled.

For something that is, for many, an afterthought, packaging plays an outsized and underappreciated role in the food and beverage industry. Brands should weigh packaging selection as carefully as they do other ingredients in the manufacturing mix, and choose wisely to create products that are sustainable, high value, and protect consumers and the bottom line.

1. www.doingwhatsgood.us/growth/fullpost/beverage-packagers-its-time-to-think-small

2. www.doingwhatsgood.us/growth/fullpost/grab-and-go-sales-soar-how-to-take-advantage-of-this-beverage-growth-trend

3. www.marketingmag.ca/brands/nice-package-look-better-greener-on-the-shelves-49220

4. www.tetrapak.com/about/newsarchive/growing-demand-renewable-materials