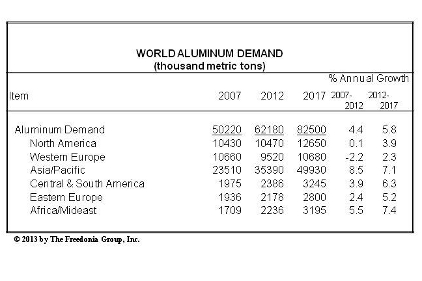

World demand for aluminum (primary and secondary/recycled) is projected to expand 5.8 percent per year through 2017 to 82.5 million metric tons. Of the 20 million additional metric tons of demand in 2017, nearly 11.5 million metric tons will be accounted for by China. The country is also a significant aluminum producer and ran a trade surplus of 700,000 metric tons in 2012. In fact, China’s trade surplus and an associated global supply glut were largely to blame for a significant drop in global aluminum prices in 2012. These and other trends are presented in World Aluminum, a new study from The Freedonia Group, Inc. (freedoniagroup.com), a Cleveland-based industry market research firm.

Due primarily to the massive market in China, construction will remain the largest market for aluminum, with gains benefiting from a recovery in the housing sectors of a number of developed nations as well as rapid increases in construction spending in the developing world as a result of strong economic growth and urbanization. If excluding China, the motor vehicle market is the world’s largest user of aluminum. In most countries, motor vehicles account for a greater share of aluminum use than construction applications.

Aluminum use in the motor vehicle market will see gains in excess of the overall market and will continue to benefit as car manufacturers strive to increase the fuel efficiency of their fleets by reducing the average weight of each vehicle. Motor vehicle aluminum demand in developing countries will also benefit from the fact that current car ownership rates are low, leaving plenty of room for future growth. Aluminum use in packaging will advance due to rapid proliferation of processed food and beverage products in developing countries.

Demand for aluminum will exhibit strong growth in all developing regions, with the Asia/Pacific region posting particularly strong gains. Rising disposable incomes in developing countries will result in a healthy expansion in demand for key aluminum consuming products such as motor vehicles, packaged food and beverage products, and durable goods. Although the US, Western Europe, and Japan will all post recoveries from the declines registered during the 2007-2012 period, aluminum demand in all three developed areas will continue to grow at a significantly slower pace than the world average.