Produce sales reached $69.6 billion in 2020, an 11.4% increase according to “Power of Produce 2021,” a recent report from the Food Industry Association (FMI). The report also found that grocery shoppers are purchasing more produce than they were before the COVID-19 pandemic, with consumers purchasing more fresh fruit (up 8.9%) and more vegetables (up 14.2%).

Packaging Strategies asked Rick Stein, vice president of fresh foods at FMI, what specific trends were driving the growth of produce sales, “We see two major trends driving the growth of produce sales: at-home cooking and health and well-being. Shoppers tell us they are cooking more at home; they are eating more vegetables at dinner and lunch and more fruit for breakfast and snacks. Half of shoppers are integrating fruits and vegetables into their meal plans somewhat or a lot more often, and 71% of grocery shoppers say nutrition and health is a primary or important reason for purchasing fruits and vegetables.”

For consumers, the need for convenience is paramount. The share of shoppers who purchase value-added produce — pre-washed or cut — increased from 31% in 2019 to 37% in 2020. Three out of 10 shoppers believe they will purchase more value-added produce in the upcoming year — the highest share in four years.

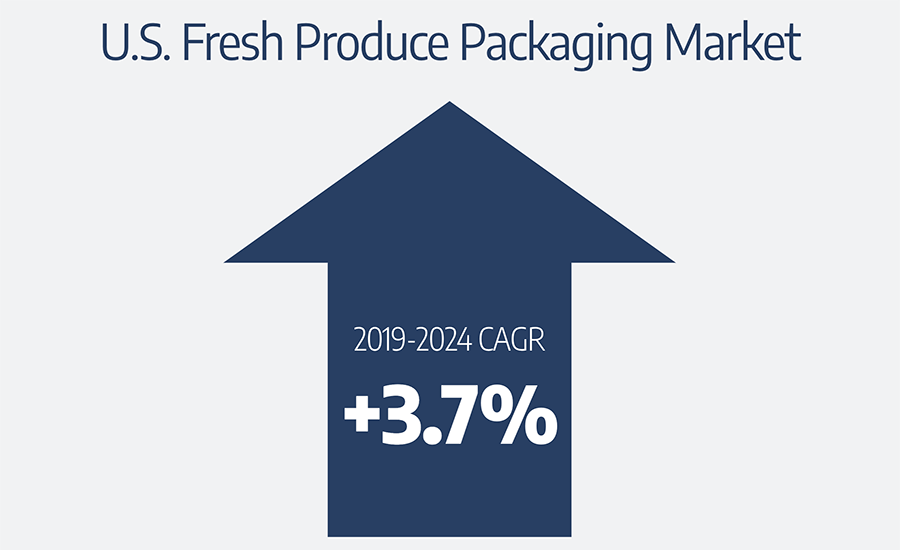

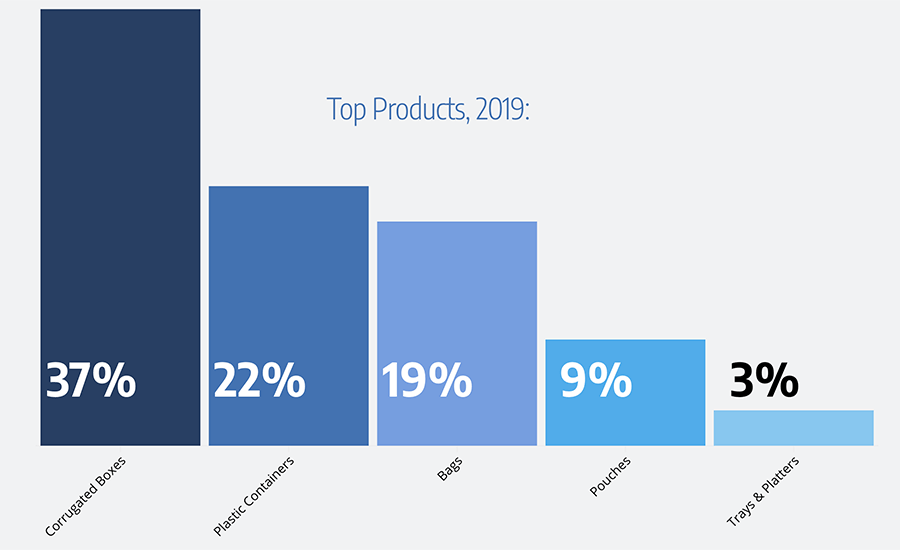

This shift in consumer behavior has created a demand for fresh produce packaging. According to The Freedonia Group, fresh produce packaging is forecast to increase 3.7% per year to $6.7 billion in 2024. Sales gains will be driven by rising demand for produce sold in some form of packaging — including pouches, bags and rigid plastic containers — and more intensive use of packaging that offers convenience, ease-of-use, superior performance and shelf life, and improved environmental footprint.

Rigid Plastic Containers to Outperform All Other Major Packaging Types

Sales of plastic containers are expected to outpace those of all other common used types of produce packaging, as clamshells and other plastic containers continue to supplant commodity bags and pillow pouches due to their good protective and display properties, especially with RTE foods such as salads and pre-cut/pre-sliced fruits and vegetables.

Salad & Berries Remain Largest Fresh Produce Packaging Applications

Salad and berries will remain the largest markets for fresh produce packaging in value terms, together accounting for more than 20% of demand. Salad’s market position is supported by its strong sales in consumer and foodservice markets, as well as by its intensive use of higher-value packaging types, such as two-piece plastic containers and modified atmosphere packaging (MAP). Berry packaging sales are similarly aided by strong consumer demand as well as by their relatively intensive use of higher-cost rigid packaging containers due to their greater need for protection compared to other produce types.

Sustainability Remains a Primary Goal for Produce Packaging Suppliers

Although the COVID-19 pandemic has brought with it a greater focus on cleanliness and sanitation for food packaging, sustainability is regaining strength as a key focus for suppliers — especially since consumers who purchase fresh fruits and vegetables tend to be environmentally conscious. Consequently, packaging producers are focusing on improving product recyclability, increasing use of recycled content and extending shelf life.

Key Trends Through 2024:

- Rigid plastic containers to outperform all other major packaging types.

- Salad and berries to remain largest fresh produce packaging applications.

- Sustainability remains a primary goal for produce packaging suppliers.

Leading Industry Players:

- Amcor

- Berry Global

- Cascades

- Georgia-Pacific

- International Paper

- Packaging Corporation of America

- Pactiv Evergreen

- Sonoco Products

- WestRock

Sidebar Source: The Freedonia Group