The Coronavirus outbreak is a human tragedy with very real business and economic consequences. Business leaders globally are in uncharted waters as together we face the challenges surrounding the recent pandemic and resulting economic impact. Insight into how others are reacting, overcoming current challenges and planning for tomorrow can provide us with not only comfort, but a shared community of learning and preparation.

The bringing together of industry professionals to share their experiences with the Coronavirus/COVID-19 as related to business activities including planning, staffing, investing and marketing in an online survey, provides a collective industry perspective. This is a perspective that will continue to change over time; a perspective that can help inform the business decisions we make today as well as our future plans. This is a perspective that can unite the industry and encourage collaboration; a perspective that will be monitored and reported as events continue to evolve.

Clear Seas Research, a BNP Media Company, polled publication subscribers across its food and beverage manufacturing titles the week of March 23, 2020 to address:

- Industry concern related to the pandemic and the impact on business and the economy.

- The impact of the pandemic on industries targeted for this research.

- Measures being taken to keep employees, customers, and others health/safe.

- How industry professionals are managing current business activities and planning for the future.

Business Outlook

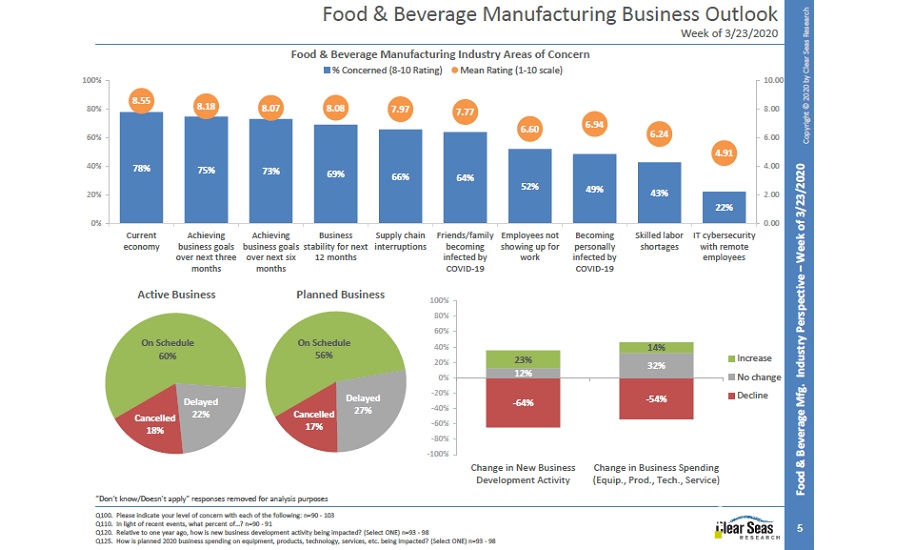

In terms of business outlook, food and beverage manufacturing respondents cited the current economy as an industry area of concern. Seventy-eight survey-takers listed this area of concern netting an 8.55 mean rating scale.

This was followed by achieving business goals over the next three months with 75% indicating as much, netting an 8.18 mean rating. Other top concerns for respondents were achieving business goal over the next six months (73% and 8.07 mean rating), business stability for the next 12 months (69% and 8.08 mean rating), and supply chain interruptions (66% and 7.97 mean rating).

When asked about how active business has been impacted, 60% noted that it remained on schedule with 22% noting a delay and 18% citing cancellations. In terms of planned 2020 activity, 56% noted that it remained on schedule while 27% cited a delay. Seventeen percent of respondents indicated cancellation impacts.

Employee Engagement

With food and beverage manufacturers being designated as essential businesses from the federal government, the safety of their employees remains top of mind for them.

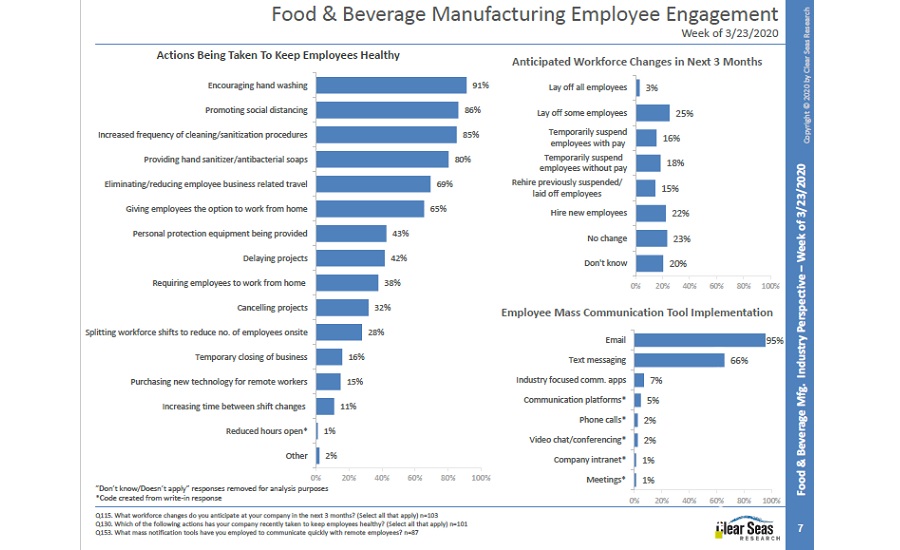

When asked what actions are being taken to keep employee healthy, 91 percent of respondents stated encouraging hand washing, followed by promoting social distancing with 86 percent. Rounding out the Top 5 are as follows:

- Increased frequency of cleaning/sanitizing procedures (85 percent)

- Providing hand sanitizer/antibacterial soaps (80 percent)

- Eliminating/reducing employee business related travel (69 percent)

Given the shifts to traditional work load, respondents were asked to indicate their anticipated workforce changes in the next three months. The results showed a diverse set of plans:

- 25% anticipate laying off some employees.

- 23% anticipate no change.

- 22% anticipate hiring new employees.

- 20% don’t know.

- 18% anticipate temporarily suspending employees without pay.

- 16% anticipate temporarily suspending employees with pay.

- 15% anticipate to rehire previously suspended/laid off employees.

- 3% anticipate laying off all employees.

Greater Focus

As food and beverage manufacturers adapt to this current business market, respondents were asked which of the following activities they are doing more now than they had been six months ago to prepare themselves and their business for when things turn around.

The top response by survey-takers was incorporating additional/health safety procedures into business plans with 38% indicating as such. This was followed by a three-way tie (each 25% respectively): reading more industry publications (digital or print); increasing marketing efforts to remain top of mind; and learning new skills.

To access more information from the report, please click here.