Exploring Aseptic and ESL Solutions for Dairy

Aseptic and ESL packaging solutions have become a key staple in the dairy sector.

Image Source: Sandipkumar Patel / DigitalVision Vectors via Getty Images

The dairy industry has seen significant innovation over recent decades, particularly in packaging. Traditional packaging methods, which often require refrigeration and have limited shelf life, have largely been supplemented, or even replaced, by aseptic and Extended Shelf Life (ESL) technologies. These advancements have revolutionized the storage, transportation and distribution of dairy products, meeting the demands of modern consumers for convenience, extended freshness and greater variety.

As a result, aseptic and ESL packaging has become indispensable in the dairy industry, not only because they improve product safety, but also by expanding the geographical reach of products by reducing food waste.

The anecdotal rise of aseptic and ESL packaging is supported by its projected market growth. Per Fortune Business Insights, the global aseptic packaging market reached a total of $72.07 billion in 2023, with a projected increase to $80.06 billion by the end of 2024.

“Aseptic packaging has really proven itself in economies and markets around the world that typically don’t have the luxury of refrigeration. In North America, we have that luxury down to a convenience store level where in other parts of the world they may not even have that luxury at a large retail level,” explains David Watson, Category Director – Food Closures, Bericap. “This type of packaging has allowed sensitive products to get from the farm to the factory, have a very long and stable shelf life and almost be used in a military type fashion where you can store them for emergencies and things like that.”

The Process

In order to fully understand the impact of aseptic packaging, it is important to have a clear concept of the process. According to United States Department of Agriculture (USDA), “aseptic packaging is the process by which microorganisms are prevented from entering a package during and after packaging.

During aseptic processing, a sterilized package is filled with a commercially sterile food product and sealed within the confines of a hygienic environment.”

This method allows dairy products to be stored at room temperature for an extended period of time without the use of preservatives or refrigeration, which can extend the shelf life of products by several months.

When it comes to ESL packaging, its goals are largely similar to those of aseptic packaging, but it varies slightly in terms of process and results. ESL typically relies on a combination of ultrafiltration, heat treatments and controlled filling environments to delay spoilage. While ESL products usually require refrigeration and have a shorter shelf life than aseptically packaged products, they still have a longer shelf life when compared to conventionally pasteurized dairy products.

“If [a dairy product] is going to be refrigerated, you can do ESL with no problems,” explains Matthew Gwin, Product Manager, Waldner North America. “If it’s going to be shelf-stable, you really have to do aseptic.”

Anything is Possible

Aseptic and ESL packaging accomplishes its end goal of making dairy products more durable and shelf-stable, and from a technology angle, suppliers have largely kept up with adjustments required by the emergence of these types of packaging.

As an example, Bericap, a provider of closure solutions for food, beverage and industrial applications, has been ready for the advent of aseptic packaging thanks to its global footprint.

“There were certain challenges like getting new original equipment manufacturers (OEMs) and consumer packaged goods (CPGs) involved in aseptic packaging up to speed, but we were one of the suppliers that were more or less ready to go,” says Watson.

“We were quite well positioned to move into aseptic packaging, especially in North America,” he continues. “Bericap is global, so we have factories on all continents, and we were already well exposed to aseptic packaging in other regions of the world. So when CPGs did come to us and asked if we were capable, we could already bring in experience and technology from other regions.”

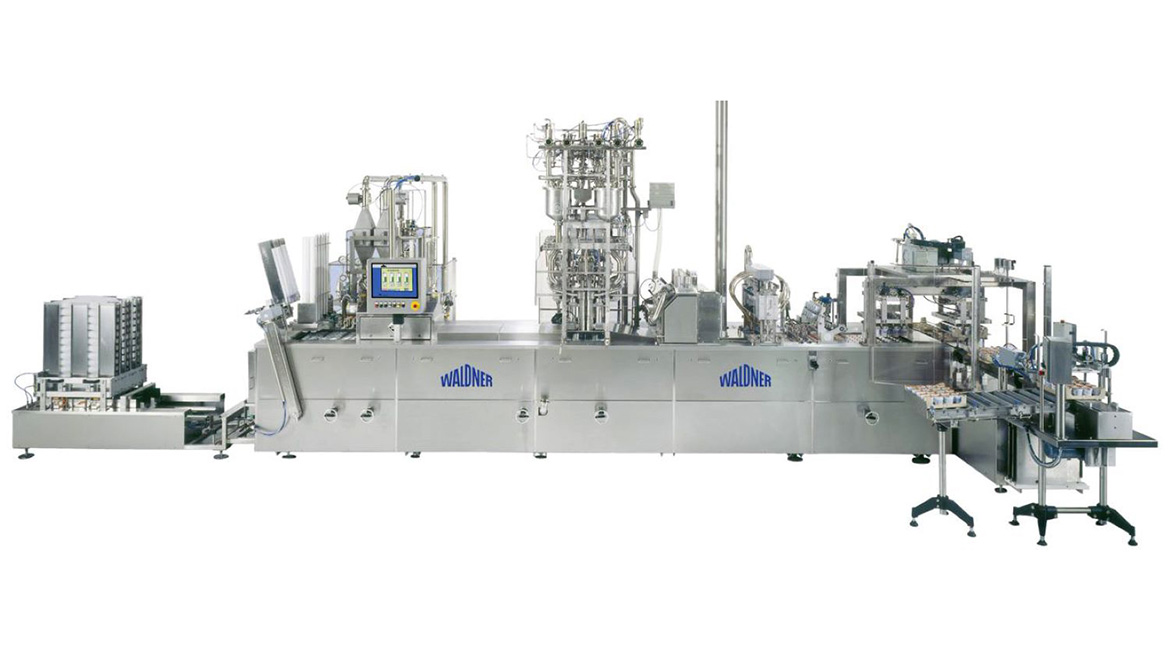

Waldner North America, a provider of automated filling and sealing packaging equipment for shelf stable food products in a variety of containers, has seen real growth in this space because of its versatile machinery.

“Most of the ESL projects we run into are for the dairy industry. So things like sour cream, cottage cheese, yogurt…most of those are [packaged with] ESL machines,” says Gwin. “What we focus on is having our machines be highly efficient and highly flexible, and that’s where we are seeing a lot of growth on the ESL side.”

With these innovative solutions across the supply chain, it is safe to say that embracing aseptic and ESL packaging is not an issue of technological availability, but rather one of economic feasibility.

The Issue of Cost

The benefits of aseptic and ESL packaging are clear, and the technology is available, but the decision to embrace these types of packaging is not always so simple. Suppliers must consider a multitude of factors in determining whether or not aseptic and ESL packaging makes sense for their respective operations.

One major barrier to consider is cost. Updating machinery and materials so that they are compatible with aseptic and ESL packaging requires a major financial commitment from dairy brands. These commitments require a long-term vision from brands, and that might not be suitable in every situation.

Despite this drawback, it has been shown that aseptic and ESL packaging can end up saving companies money in the long run thanks to the enhanced distribution capabilities and overall product durability.

“There’s a fairly significant capital cost with the equipment,” notes Watson. “But once that major capital decision is made and the new policies are integrated into the factory, the long range recovery is there for the capital and profitability.”

The Sustainability Factor

Aseptic and ESL packaging lend themselves well to sustainable practices in a variety of ways, thus making their implementation even more attractive.

From a materials perspective, aseptic packages are able to be recycled without much additional hassle, making the transition smoother in that sense.

“Most of these aseptic packages that you’ll see in trade actually lend themselves to be quite easily recyclable because of their material makeup,” says Watson. “If you look at some of the PET and HDPE closures in the aseptic chain for example, that can simply be separated and then reintroduced as PCR [materials].”

Additionally, sustainability in aseptic and ESL packaging can also be found with the reduction of food waste. This reduction can be seen at all levels of the supply chain and gives people a longer runway to produce, distribute, purchase and consume dairy products. One part of this process is making sure filling machines are accurate and precise in order to preserve product quality and ensure it can make it to market.

“One of the things that Waldner does very well is have highly accurate filling, and that reduces waste,” explains Gwin. “We can do things like have a checkweigher in the machine that automatically [monitors] the fill weight of each cup, and we have individual drives for each fill head so so each lane can automatically adjust independently based on the cup weight, so as that product changes throughout the day we can be very accurate with how much [product is filled] so we aren’t overfilling or wasting product.”

Sustained Impact

The importance of aseptic and ESL packaging should continue to see growth in dairy settings. In fact, its role is so vital that for some products, the removal of aseptic and ESL packaging would severely limit their reach and existence.

“There are some products that wouldn’t exist if you didn’t do ESL,” says Gwin. With sour cream, for example, if it were not ESL, it’s unlikely that it would last long enough to get it in stores. It would have to be something that is rare and bought locally. ESL is very important for a lot of products to get it on the shelves.”

Suppliers are also seeing a shift toward aseptic packaging for both existing and first-time products on the market, specifically in areas like ready-to-drink and dairy-added beverages, with potential to expand even further into more traditional products.

“Over the last couple of years, more and more companies are investing in aseptic lines,” says Jennifer Hackett, Director of Business Development North America - Beverage, Bericap. “People who are investing in new lines are going the aseptic route [because] they can go lighter with closures and they’re protecting the flavor inside.”

“Where we’ve seen [aseptic packaging] going is the nutraceutical, ready-to-drink and value-add dairy, but I think ultimately you’ll start to see more aseptic products move into standard milk,” added Watson.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!