Affinnova, Inc. (www.affinnova.com), a global marketing technology company that dramatically improves innovation and marketing success rates, today released its first Package Design Audit, illustrating the importance of package design, specifically in the vodka industry. Results showed that up and coming brands Belvedere and Pinnacle are leveraging bold and unique package designs to gain market share, while attracting more consumer attention than older brands Smirnoff and Stolichnaya.

"Design remains one of the most underleveraged assets a company has in launching and maintaining a successful brand,” says Waleed Al-Atraqchi, president and CEO of Affinnova. “As advertising becomes increasingly fragmented and has less impact on consumers, packaging must work harder to build brand equity and drive purchases. Advanced marketers need to monitor how package design is impacting shelf presence and consumer perception and respond accordingly, much in the same way they actively measure and adjust other aspects of their marketing performance.”

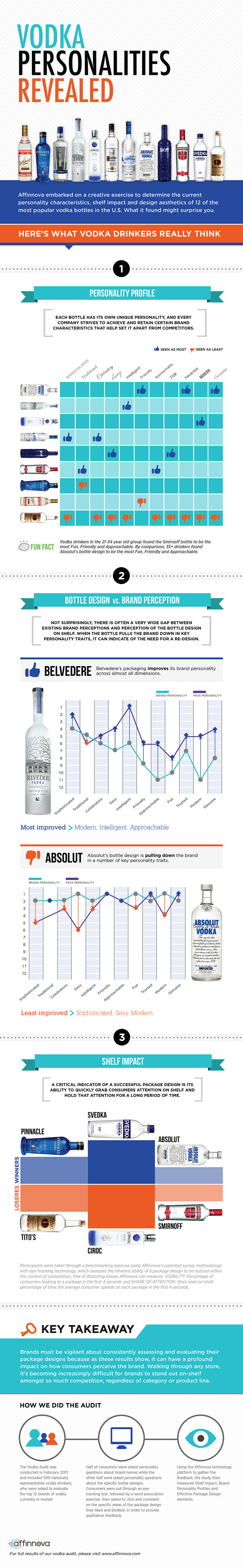

Affinnova obtained the results through its unique Design Audit technology, which measures package design impact on consumer perception across a wide range of product categories. For the vodka industry, the audit found that:

- Newer brands are winning on shelf: With unique bottle designs, including bold elements and colors, younger brands like Svedka and Pinnacle are most effective at grabbing and holding consumer attention on shelf, dramatically outperforming the industry average. By contrast Smirnoff and Stolichmaya – brands with decades of brand equity – are more likely to be overlooked by consumers on shelf.

- Stale packaging can lead to brand erosion: A poorly perceived package can quickly undermine the millions spent on advertising to build a unique brand personality. While consumers perceive Absolut’s brand as “sexy, sophisticated and modern,” the current bottle design actually erodes its brand equity in these areas. By contrast, Belvedere’s bottle design elevates its brand equity significantly in all but one of 11 key vodka personality traits.

- Gen X’ers and Boomers don’t see eye-to-eye with Millennials: To maintain competitive share, vodka brands must consider changing demographics and adjust accordingly. As an example, Absolut’s bottle design is succeeding in positioning the brand as “fun, friendly and approachable” among consumers 35 and older. However, it’s less effective with 21-34 millennial drinkers, who perceive Smirnoff as leading in those categories. It appears Absolut is well positioned for growth with older drinkers, while Smirnoff is attracting a younger base.

“While established brands are spending millions on marketing and advertising, more nimble competitors are using innovative packaging to quickly grab market share,” says Blake Howard, vice president of Design Solutions at Affinnova. “Our audit shows that established vodka brands should seize the opportunity to refine their packaging to counter new competitors in this high-growth, competitive category. They can no longer rely solely on their marketing mix or even existing brand equity to do all the heavy lifting.”

This audit is the first in a quarterly series from Affinnova. To view extensive results on all 12 vodka brands included in this audit, visit: www.affinnova.com/vodka-audit.

Read more in the infographic below. (Click to view a larger version).